globalbizmag.com

Bahrain’s economy recovering, says its central bank

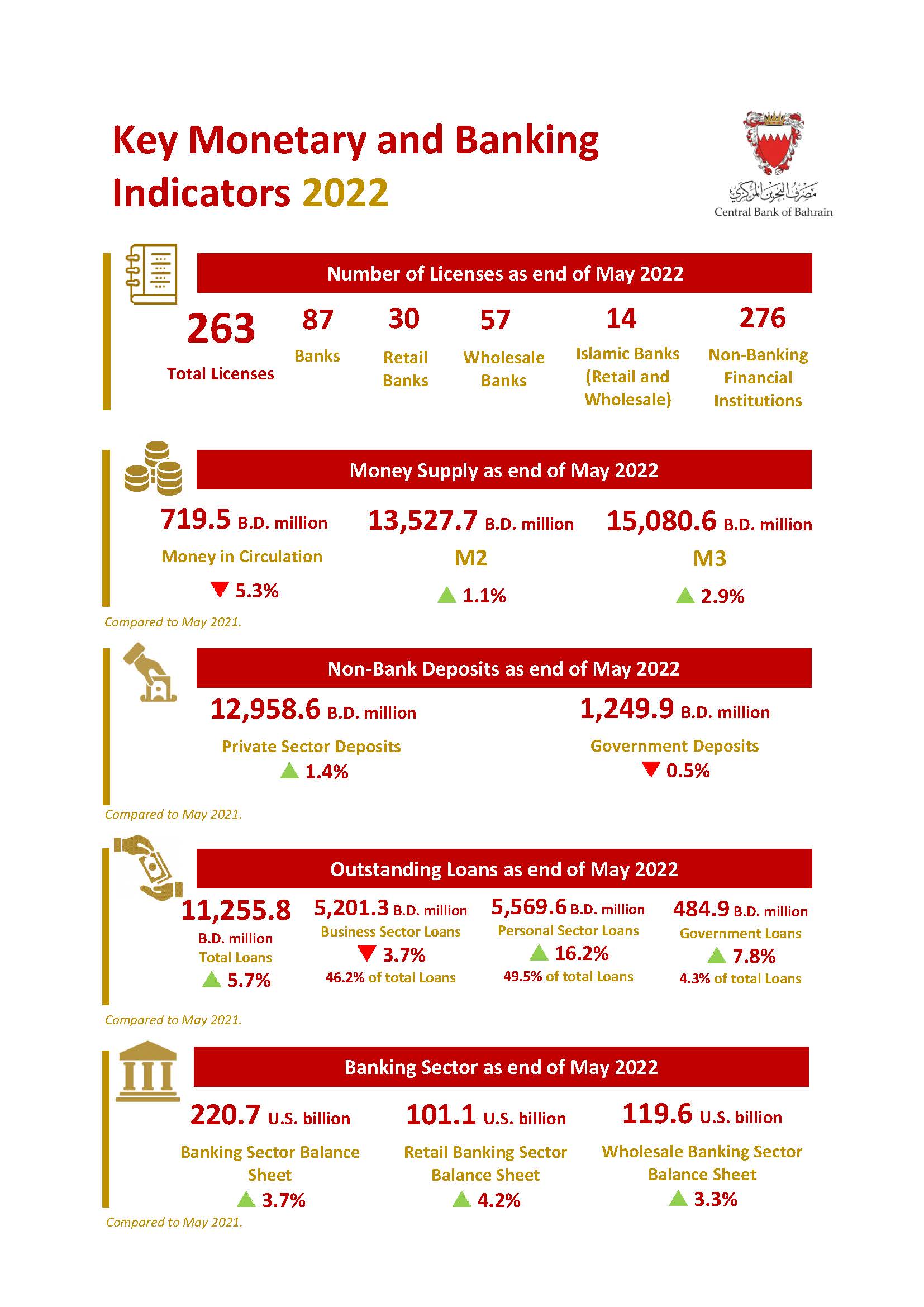

In an indication of economic recovery, the Central Bank of Bahrain (CBB) has said that loans and credit facilities rose 5.7% in Bahrain to $30.05 billion till the end of May 2022 when compared with the corresponding period in 2021.

Business sector accounted for 46.2% total outstanding credit while the proportion of personal loans was 49.5%, the CBB said in a statement after its Board of Directors meeting on June 26.

This was the second board meeting for 2022 chaired by Chairman Hassan Al Jalahma and it reviewed the CBB’s performance report and developments in the financial sector for Q2 of 2022 and the CBB’s financial performance report as of end of May 2022.

The CBB also said that key indicators were consistent with the return of activity to all economic sectors in the country and demonstrate the financial sector’s stability and capacity to serve the national economy.

Liquidity Stable

Data showed stable liquidity whereby money supply in its broad sense, M3 totalled $40.05 billion till the end of May 2022, an increase of 2.9%c compared with the corresponding period last year. As for retail banks, total private deposits increased to around $34.5 billion as of last month’s end, an increase of 1.4% compared with the same period last year.

The balance sheet of the banking system (retail banks and wholesale sector banks) increased to $220.7 billion as of May 2022, an increase of 3.7% from the level of corresponding period last year.

Point of Sale (POS) data also showed an increase in the number of transactions during the first five months of 2022, totalling 63.6 million, 73.1% of them contactless, which is 40.4% higher compared with the same period in 2021.

POS Transactions Rise

The total value of POS transactions in Bahrain during the period totalled $3.98 billion, 45.4% of them contactless, an increase of 32.7% compared with the same period in 2021.

The banking sector maintained a high level of liquidity, as the capital adequacy ratio of the banking sector amounted to 19.5% in Q1 of 2022 as against 18.5% in the first quarter of 2021.

The capital adequacy ratio for the various banking sectors in Q1 of 2022 was 21.3% for conventional retail banks, 17.8% for conventional wholesale banks, 21.3% for Islamic retail banks, and 16.4% for Islamic wholesale banks.

The board also reviewed the work in progress with regards to the Financial Services Sector Development Strategy (2022-26).