MENA’s Offshore Wind Energy Potential Is 1,400 GW

The total offshore wind potential in the Middle East and North Africa (MENA) is estimated to be around 1,400 GW but the only offshore activities in the region are that of offshore oil and gas, the World Wind Energy Council said.

In its latest report on the recent developments in the industry, the Council said that the industry is still in a nascent form in the region, with only a few countries, such as Saudi Arabia, Oman, Morocco and Egypt making efforts to develop the same. The significant potential of offshore wind indicates that there should be development in the region.

“However, this depends greatly on the investment environment, national regulations, and permitting procedures, as well as the availability of a skilled workforce with experience in this industry,” the report noted.

Given the weather conditions and geographical location, the Middle East is often positioned as an ideal spot for solar developments, at times overlooking its equally significant wind potential.

Given the larger investments involved in offshore wind and the readily available onshore locations in most of the Middle East, the region has yet to see any real development of its offshore wind market. However, trends are shifting in the Middle East as efforts to diversify energy sources, potential development of subsea interconnectors to Europe, and the potential of green energy/green product exports may encourage MENA countries to reconsider their original stance on offshore wind.

Saudi’s Potential

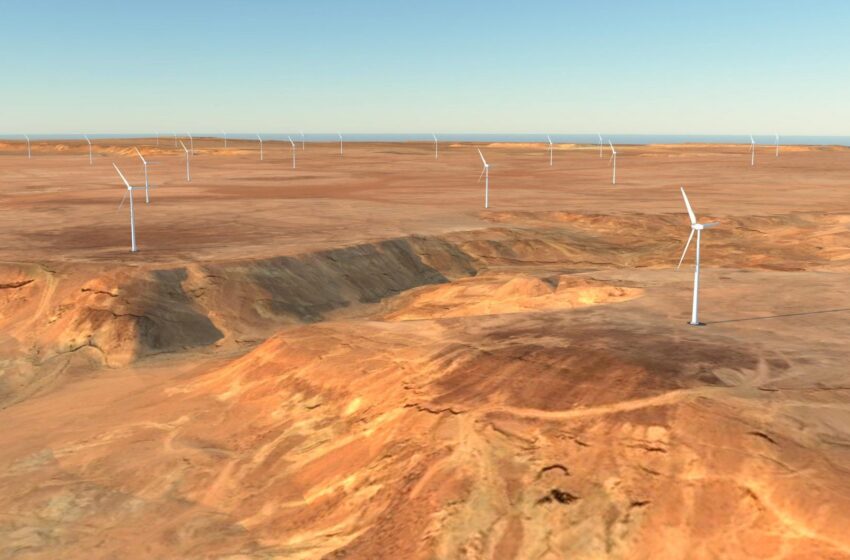

Saudi Arabia is among the potential countries in the MENA region for offshore wind development with an overall capacity of 106 GW along its eastern and western coasts. However, the oil-rich Kingdom currently has only one onshore wind farm in operation (Dumat al Jandal) but has ambitious further renewable energy plans.

By 2040, the country aims to generate half of its energy supply from renewable energy sources and to reach net zero by 2060. In addition, futuristic endeavours such as NEOM have promised to turn Saudi Arabia into a frontrunner in the energy transition race.

The launch of green hydrogen schemes and the potential to export of green products, including green hydrogen derivatives, are encouraging for the development of both onshore and offshore wind.

Global Production

Across the world in 2023, the wind production industry connected 10.8 GW of offshore wind to the grid representing a 24% year-on-year increase, the second-best year ever despite headwinds in key markets. This brought the total global offshore wind capacity to 75.2 GW by the end of last year.

China led the world in annual offshore wind developments for the sixth year in a row with 6.3 GW added in 2023, demonstrating its capability to maintain stable growth in the new era of grid parity. China was followed by three other markets, which commissioned new offshore wind capacity in Asia and they included Taiwan (692 MW), Japan (140 MW), and South Korea (4.2 MW) respectively.

“It’s important to note that the offshore wind industry and its partners in government, institutions, and civil society are now coalescing and driving momentum in anticipation of the industry’s impending growth and importance as a clean energy technology,” the report said.

Signals from around the world show the industry is building momentum as membership of the Global Offshore Wind Alliance (GOWA), a diplomatic, multi-stakeholder initiative founded by GWEC, IRENA, and the Government of Denmark, has swelled to over 20 governments.

These governments have pledged to collaborate towards installing 380 GW of offshore wind by 2030 and 2000 GW by 2050.