ADNOC L&S Reports Revenue of $1.26 Billion in Q2

Surpassing market expectations and demonstrating resilience and operational strength in a volatile market, ADNOC Logistics and Services, a global energy maritime logistics company, on Tuesday reported record-breaking second-quarter (Q2) and first-half (H1) results for 2025.

ADNOC L&S’s outstanding Q2 revenue increased by 40% y-o-y to around $1.26 billion with EBITDA growing 31% y-o-y to $400 million and the company said that its net profit for the quarter grew 14% y-o-y to $236 million.

In H1 2025, the Company’s revenue was close to $2.44 billion, a 40% y-o-y increase. EBITDA rose by 26% y-o-y to $744 million, driven by robust performance across all business segments, sustaining EBITDA margin at 30%.

Net profit for H1 2025 was $420 million, up 5% y-o-y and up 18% compared with H2 2024. ADNOC L&S’s diverse and resilient business model enabled the company to deliver strong net profit and operating cash flow despite challenging shipping charter rate environments in Gas, Tankers, and Dry Bulk.

Driven by strong performance in its core business segments and improving margins, ADNOC L&S has upgraded its full-year guidance, expecting faster growth due to continued momentum and enhanced operational efficiency across key areas.

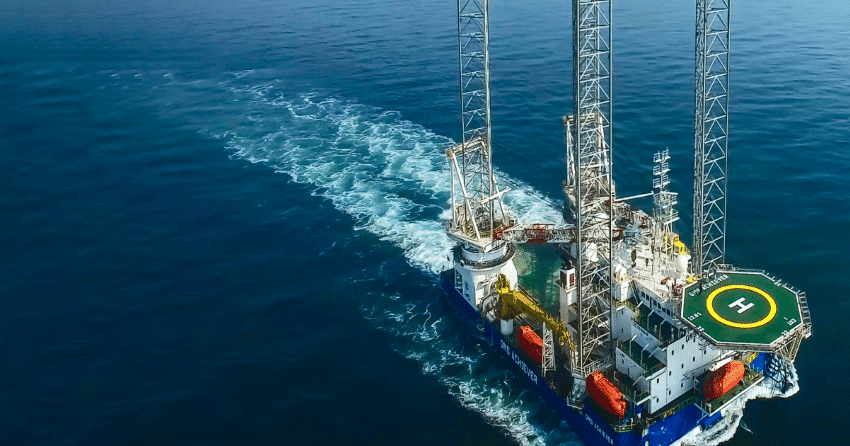

The company continues to enhance value and streamline operations across its diverse asset portfolio, while advancing integration and innovation through its shipping and logistics subsidiaries, Navig8 and Zakher Marine International (ZMI).

ADNOC L&S CEO Captain Abdulkareem Al Masabi said that they were proud of their highest-ever quarterly results, underscoring the strength of the company’s growth strategy and their ability to capitalise on diversified opportunities across our Integrated Logistics, Shipping and Services segments.

“This record-breaking performance reflects ADNOC L&S’s continued outperformance of market expectations, driven by robust cash flows, strategic partnerships, and operational excellence. In line with this momentum, our upgraded full-year guidance demonstrates our confidence in delivering long-term value to shareholders,” he added.

Strong Segmental Growth

Integrated Logistics: The segment delivered a solid performance, with revenues rising 22% y-o-y to $1.3 billion reflecting strong demand and strategic growth in key areas. As a result, EBITDA rose by 27% y-o-y to $420 million, highlighting the segment’s significant contribution to the company’s overall results. This strong growth was mainly driven by continued strong utilisation and rates on Jack-up Barges (JUBs), improved profitability on Integrated Logistics Solution Platform, and increased chartering activity beyond ILSP. Additionally, Engineering, Procurement and Construction (EPC) projects, including the G-Island and Hail & Ghasha, contributed to strong revenue growth.

Shipping: The segment demonstrated exceptional growth, with revenues surging 89% y-o-y to $981 million. This performance was primarily driven by the consolidation of revenue from the Navig8 tanker fleet, marking a key milestone in the company’s strategic expansion.

Shipping EBITDA increased by 25% y-o-y to $290 million, despite substantially weaker market conditions than H1 2024, reflecting strong operational execution.

Services: The segment continues to extend ADNOC L&S’s diversified business model, with revenues rising 4% y-o-y to $165 million. EBITDA grew 22% y-o-y to $33 million, primarily driven by higher volumes at the Borouge Container Terminal and the share of profit from Navig8’s bunkering business (Integr8).