Abu Dhabi’s SWFs Makes It World’s Richest City

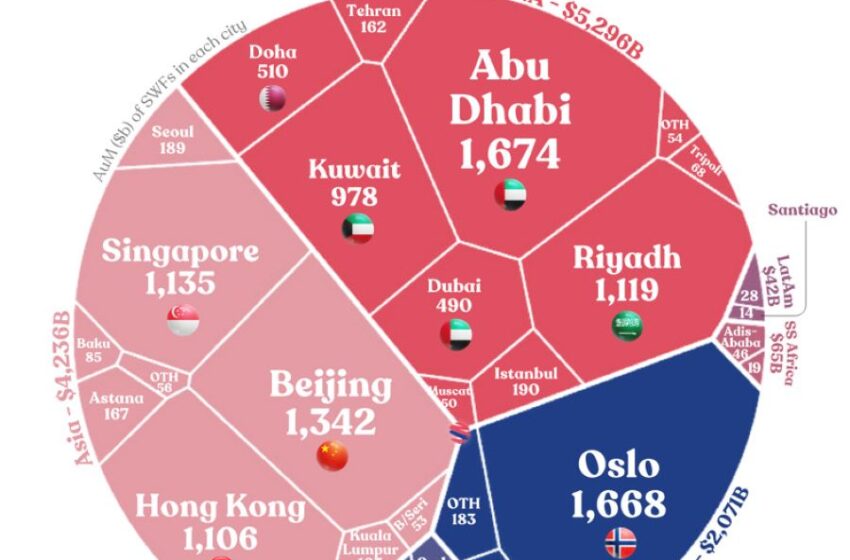

The UAE’s capital Abu Dhabi is the world’s richest city in terms of capital managed by its Sovereign Wealth Funds (SWFs), with $1.7 trillion as of October 2024, according to Global SWF, a Data Platform that tracks over 400 Sovereign Wealth Funds (SWFs) and Public Pension Funds (PPFs) across the world.

This figure includes the assets of ADIA, Mubadala (including ADIC and Mubadala Capital), ADQ (including part of Lunate), aid fund ADFD, Tawazun (including EDGE), and federal fund EIA, the data compiled and curated by Global SWF showed.

Following Abu Dhabi are Oslo (home of the world’s largest SWF, NBIM), Beijing (CIC), Singapore (GIC, Temasek), Riyadh (PIF) and Hong Kong (where China’s second SWF, SAFE IC, operates from). This figure does not consider the significant capital managed by Abu Dhabi’s Royal Private Offices (RPOs), which can have blurred boundaries with SWFs and account for $344 billion.

In addition to the financial capital, Abu Dhabi also leads when it comes to human capital, i.e., personnel employed by SWFs of that particular jurisdiction, with 3,107 staff among the above-mentioned funds.

SWFs managed $12.5 trillion in assets as of 1 October 2024, with six cities representing two-thirds of the resources, and Abu Dhabi securing the top spot as the Capital of Capital. By 2030, the assets under management (AUM) of Abu Dhabi SWFs could rise to $2.3 trillion, and the AUM of all its Sovereign Investors, $3.4 trillion.

Most investment activity is spearheaded by ADIA, Mubadala, and ADQ, which invested $36 billion in the first three quarters of 2024. Historically, a sixth of all investments has been domestic (mainly, Mubadala and ADQ), while the rest has been directed to the US, the UK, Spain, India, and China, Global SWF said.

Regionally Active

Abu Dhabi SWFs are not only the most sizeable but also the most active in the region and globally. In the first three quarters of 2024, ADIA, Mubadala, and ADQ invested $36 billion in deals across the world, i.e., two-thirds of what all Gulf SWFs invested, and 26% of what all SWFs globally invested in that period.

Abu Dhabi is the largest emirate of the UAE in terms of land (81%) and oil reserves (94%) and is therefore home to the country’s largest assets and SWFs. Of the UAE’s $456 billion economy in 2023, 68% ($310 billion) is contributed by Abu Dhabi, 26% by Dubai, and 6% by the Northern Emirates.

According to Global SWF analysis, 68 financial services firms, including Nuveen, PGIM, General Atlantic, Seviora, and Blue Owl, registered at ADGM in the first three quarters of 2024. In addition, the foreign direct investment (FDI) inflow into the UAE has not stopped growing since 2015, and it peaked at $30.7 billion in 2023.

Global SWF estimates that by 2024 Abu Dhabi-based SWFs manage $1.7 trillion in assets. These include Abu Dhabi institutions ADIA, Mubadala, ADQ, ADFD, Tawazun, and all their subsidiaries, as well as the Federal SWF, the Emirates Investment Authority (EIA), which is headquartered in Abu Dhabi.

This is in addition to Central Banks ($0.2 trillion), Public Pension Funds ($0.1 trillion), and Royal Private Offices ($0.3 trillion), for a combined $2.3 trillion.

However, Abu Dhabi SWFs have seen their assets under management (AUM) decrease only on two occasions: in 2015, due to the oil shock; and in 2022, due to the crash in global financial markets.