globalbizmag.com

Aramco Eyes 10% Stake in China’s Hengli Petrochemical

Aramco, one of the world’s leading integrated energy and chemicals companies, has entered discussions with Hengli Group Co., Ltd. regarding the potential acquisition of a 10% stake in Hengli Petrochemical Co., Ltd., subject to due diligence and required regulatory clearances.

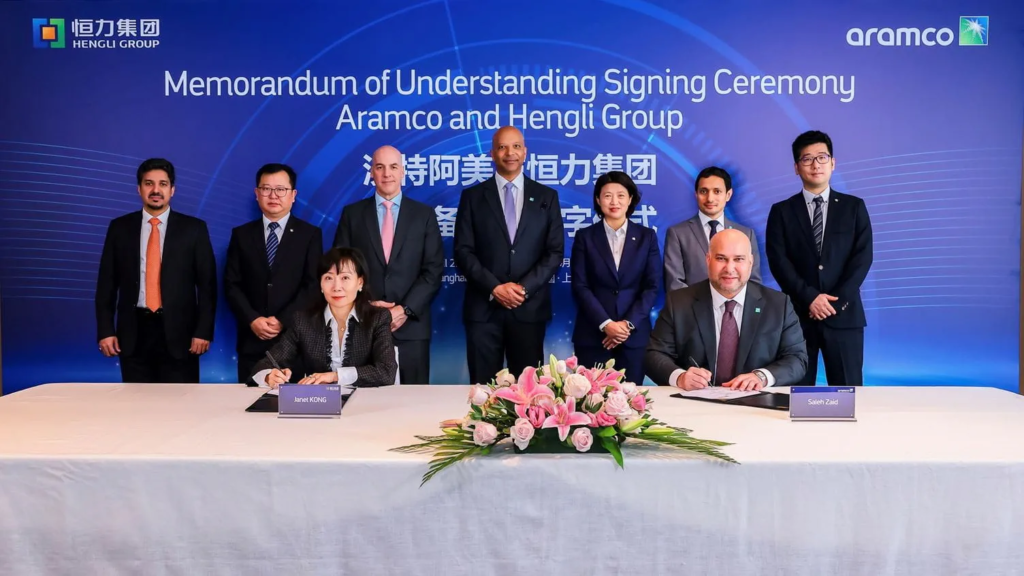

The two companies signed a Memorandum of Understanding (MoU) regarding the proposed transaction, which aligns with Aramco’s strategy to expand its downstream presence in key high-value markets, advance its liquids-to-chemicals program, and secure long-term crude oil supply agreements.

Hengli Petrochemical, a controlled subsidiary of Hengli Group, owns and operates a 400,000 barrel per day refinery and integrated chemicals complex in Liaoning Province, China, and several plants and production facilities in Jiangsu and Guangdong Provinces.

The deal “aligns with Aramco’s strategy to expand its downstream presence in key high-value markets, advance its liquids-to-chemicals program, and secure long-term crude oil supply agreements,” Aramco said.

It may be recalled that Aramco CEO Amin Nasser said in late March that the company intends to invest further in China’s chemicals sector with local partners, noting that China has a vitally important place in the company’s global investment strategy.

The energy giant aims to increase its liquids-to-chemicals throughput to 4 million barrels per day by 2030, which will require a wider footprint in China, the world’s biggest chemical market and the investments will fuel further growth in the Chinese economy.

Mohammed Y. Al Qahtani, Aramco Downstream President, said that this MoU supports Aramco’s efforts to grow its global downstream footprint.

“We continue to explore new opportunities in important markets, as we seek to progress in our liquids-to-chemicals strategy. We look forward to forging new partnerships and are excited by the prospect of expanding our presence in the important Chinese market,” he added.

Aramco’s Planned Investments

Since 2022, Aramco has embarked on major investments in China, which involved taking strategic stakes in companies with major petrochemical projects under way.

Aramco and Rongsheng Petrochemicals held cross acquisition talks in January this year with Rongsheng to acquire 50% stake in Saudi Aramco Jubail Refinery Co (SASREF) and Aramco to take a maximum 50% stake in Rongsheng’s Ningbo Zhongjin Petrochemical and jointly develop Zhongjin’s upgrading/expansion and a new advanced materials project in Zhoushan.

The Saudi oil major has also offered to buy 10% stake in Shandong Yulong Petrochemical, a refining and petrochemical complex in Yantai, which is a joint venture project being developed by Shandong Energy and Chinese conglomerate Nanshan Group.

Aramco also planned to buy 10% stake in Shenghong Petrochemical in September 23 last year and acquired 10% stake in Rongsheng Petrochemical in July last year.

Works on the $12 billion Huajin Aramco Petrochemical Co (HAPCO) in China, in which Aramco holds 30%, were launched in March 2023 and the project is expected to be commissioned in March 2026.