GCC SWFs Assets to Reach $18 Trillion by 2030

Gulf Sovereign Wealth Funds (SWFs) continue to dominate the global investment landscape, spearheading an industry-wide expansion that has pushed total assets under management globally to $12 trillion by the end of 2024 and forecast to reach $18 trillion by 2030, according to a new report by Deloitte Middle East.

The SWF landscape has witnessed tremendous growth over the past two years, with new SWFs established around the world, high-profile acquisitions by existing firms, and value of assets under management hitting fresh highs.

Gulf funds, which control approximately 40% of global SWF assets and represent six of the ten largest funds worldwide by Assets Under Management (AUM), are reshaping investment strategies amid increasing regional competition and evolving market dynamics.

The total number of SWFs globally has roughly tripled since 2000, reaching approximately 160-170 funds, with 13 new entities established between 2020 and 2023.

The report, entitled “Growth in funds, and assets drives SWF’s landscape,” revealed that Gulf SWFs have maintained an aggressive investment pace, deploying $82 billion in 2023 and an additional $55 billion in the first nine months of 2024.

Five major players – the Abu Dhabi Investment Authority (ADIA), Abu Dhabi’s Mubadala and Abu Dhabi Developmental Holding Company, Saudi Arabia’s Public Investment Fund (PIF), and the Qatar Investment Authority (QIA) – continue to dominate activity in the region.

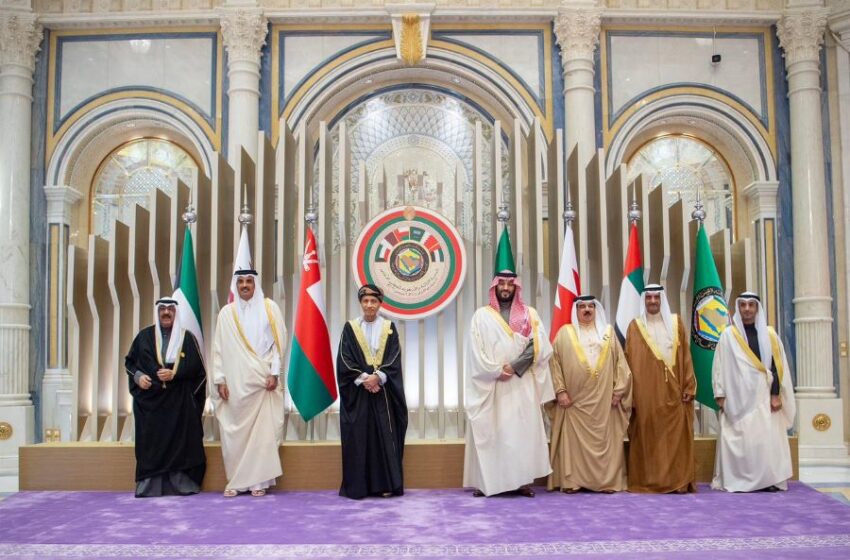

GCC Epicentre of SWF Activity

Julie Kassab, SWF Leader at Deloitte Middle East, said that the Gulf region continues to be the epicentre of SWF activity, with its major players driving innovation in investment strategies and operational excellence.

“We are witnessing these funds not only expand their geographical footprint but also significantly enhance their internal capabilities, setting new standards for the industry in terms of performance and governance,” Kassab said.

The report also showed several significant trends reshaping the regional SWF landscape, as GCC funds were looking increasingly towards fast-growing countries outside the traditional Western markets.

The Gulf funds are strategically pivoting toward Asia, with many establishing new offices throughout Asia-Pacific and substantially increasing allocations to high-growth economies including China, India, and Southeast Asia.

The sovereign funds have been particularly active in China, investing an estimated $9.5 billion in the year ending September 2024. Both ADIA and Kuwait Investment Authority (KIA) have been ranked in the top 10 shareholders in Chinese A-Share listed firms.

This represents a strategic opportunity for the Gulf SWFs as the Western investors reduced their exposure, allowing Middle Eastern funds to leverage their strong political and trade relationships with Beijing.

According to the report, Africa is also an area of interest, with the mining sector yielding new opportunities. The UAE and Saudi Arabia have shown willingness to invest in high-risk extractives ventures in Africa this year, both directly and through their holdings in multinational mining firms.

This comes alongside the emergence of new investment vehicles, particularly “Royal Private Offices,” which now control an estimated $500 billion in assets.

With more entities and more assets now being actively deployed, funds are under increasing pressure to gain a competitive edge, with a stronger focus on internal performance, risk oversight and investment management, to ultimately deliver better returns.

Many Gulf SWFs are now adopting a more proactive approach, becoming more open to divest, demanding better reporting from portfolio companies and more willing to exert influence at board level.

This drive for excellence has also sparked fierce competition for human capital, with high demand for national talent as the Gulf SWFs now employ an estimated 9,000 professionals across their operations.

The Gulf funds are offering increasingly attractive packages to senior professionals, particularly those with experience at established funds like Singapore’s Temasek or Canada’s Maple Eight.

Deloitte also noted a growing trend toward protectionism globally, particularly in developing economies, where governments were reassessing their approach to strategic assets.

This shift has led to the creation of new domestically focused funds, often designed to co-invest alongside international partners rather than compete directly with established Middle Eastern players.

Looking ahead, while geopolitical uncertainties and potential commodity price fluctuations may create headwinds, these pressures could drive greater efficiency and innovation in fund management practices.