Economic integration, democratic capital, and the ‘export’ of democracy

Giacomo Magistretti, Marco Tabellini 20 September 2021

Can democracy be exported? This column uses a large cross-country dataset from 1960 to 2015 to show that, while the ‘top-down’ imposition of political institutions is not desirable and rarely successful, democracy can indeed be ‘exported’ – from more democratic to less democratic countries – through repeated trade interactions. The finding suggests that economic integration might be advantageous to less democratic countries not only directly by fostering GDP growth, but also indirectly by favouring the transition to democracy and the socioeconomic and political benefits associated with it.

The democratic backsliding that followed the Arab Spring almost ten years ago and the recent collapse of the Afghan government have renewed interest in the question of whether democracy and, more generally, democratic values can be ‘exported’ and, if, so, under what conditions. While the ‘top-down’ imposition of political regimes is not desirable and rarely successful, many scholars have pointed to economic openness as a mechanism through which democracy might spread around the world (Eichengreen and Leblang 2008, Lopez-Cordova and Meissner 2008).

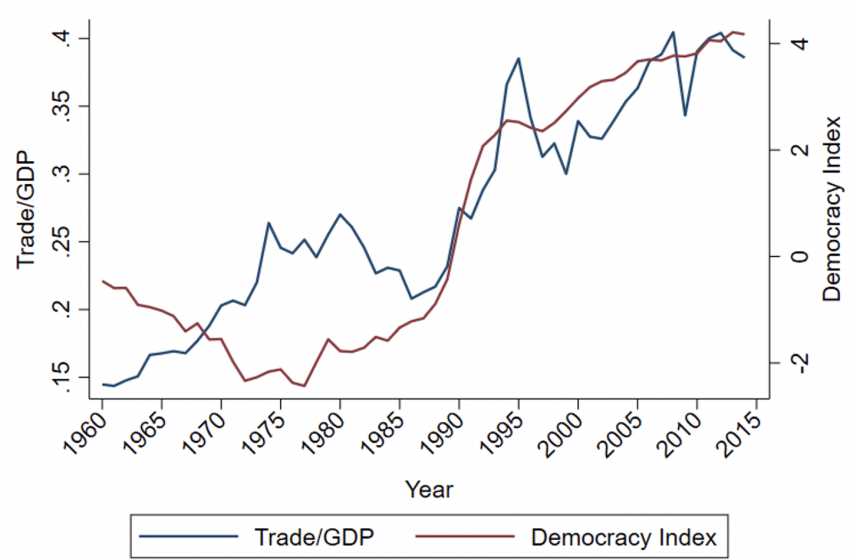

Figure 1 provides suggestive evidence that economic openness and democracy go hand-in-hand. The figure plots the cross-country average of the democracy score constructed by the Polity IV project (red line) and the value of global trade as a share of GDP (blue line). Between 1960 and 2015, the world became significantly more integrated. During the same period, the number of democratic countries increased from 48 (out of 109 for which data are available) in 1960 to 121 (out of 166) in 2015. Since the late 2000s, globalisation has slowed down amid rising backlash (Colantone and Stanig 2017, Rodrik 2017, Frieden 2019, Walters 2021), while, according to Freedom House (2020), 2019 marked the fourteenth year in a row of global democratic retreat.

Figure 1 Trends in economic integration and democracy

Are these trends causally related? Can economic integration, especially when it happens with more democratic partners, foster the process of democracy in the least democratic parts of the world? In our recent paper (Magistretti and Tabellini 2021), we study these questions using a large panel dataset of countries from 1960 to 2015. Our empirical strategy accounts for any country-specific (time-invariant) factors and any time-varying shocks common to all countries. To address further potential endogeneity issues (e.g. countries becoming more democratic first, and then opening up their economy), we rely on the ‘gravity law’ put forward in the trade literature – which models bilateral trade flows as a function of geographic distance (Frankel and Romer 1999, Anderson and Van Wincoop 2003).

Expanding on the ‘static’ notion of bilateral distances, and following Feyrer (2019), we predict trade by exploiting differential changes in the cost of air vs sea shipping. In particular, while air freight has become substantially cheaper over the last 60 years, the cost of sea shipping has not changed nearly as much (Hummels, 2007). This implies a larger decline in the effective distance between country pairs with similar sea distances but shorter air routes, such as Japan and Germany as compared to country pairs with similar air and sea distances, such as Japan and Australia. Since the change in shipping costs has been rather uniform across the globe, its differential effect on bilateral trade flows can be largely attributed to geography, and not to country-specific economic or political dynamics.

Figure 2 plots the estimated trade elasticities, with respect to sea (red line) and air distance (blue line), and confirms that the importance of air distance increased significantly between 1960 and 2015, whereas that of sea distance remained largely unchanged. As in Pascali (2017) and Feyrer (2019), we use these estimated elasticities to predict bilateral trade flows across countries and over time, aggregating them at the country level. This methodology allows us to obtain a time-varying, geography-based predicted measure of economic integration for each country and year in our sample.

Figure 2 Estimated trade elasticities

Source: Magistretti and Tabellini (2021).

Using this strategy, we find that economic integration has a strong, positive effect on democracy, which is entirely driven by integration with democratic partners. When a country becomes integrated with a democracy, its own democracy score increases significantly; instead, when economic integration occurs with non-democratic partners, no change in democracy takes place. The magnitude of these results is sizeable. According to our estimates, doubling economic integration with democratic partners for a country during a five-year period raises the democracy index by almost 3 points. This is equivalent to the difference between the democracy score of Tunisia in 2014 and that of full democracies. Since economic integration with democratic partners more than doubled at least once in a 5-year period for one quarter of the countries in our sample (e.g. Mozambique between 1985 and 1990; Poland between 1970 and 1975; South Korea between 1960 and 1965), the effects we estimate are economically large. Moreover, estimating a dynamic panel model where democracy today depends on both current and past values of trade, we document that the short-run static effects of economic integration are compounded and become more than twice as large in the long run.

In the second part of our paper, we seek to understand the mechanisms behind the pro-democracy effect of economic integration with democratic partners. A large literature argues that democracy is more likely to prevail once a certain threshold of GDP per capita is reached (Lipset 1959, Przeworski et al. 2000). Hence, in the presence of gains from trade (Donaldson, 2015; 2018), and especially from trade with democratic partners, our findings may be driven by economic growth. However, in contrast with this idea, we provide evidence that our results cannot be explained by direct income effects. We also do not find an association between economic integration and human capital accumulation – another factor that might promote democratisation (Glaeser et al. 2007).

We instead conjecture that at least part of our results are due to the transmission of democratic capital (Persson and Tabellini 2009, Besley and Persson 2019) from more democratic to less democratic countries. Through economic integration, citizens of autocratic regimes might get exposed to the institutions of their partners, updating upwards the perceived benefits of democracy – such as the protection of civil liberties, the respect of human rights, and broad-based political representation. More positive attitudes towards democracy among the population at large might, in turn, induce the elites to extend the franchise (Acemoglu and Robinson 2006). Another possibility, not in contrast with the previous one, is that leaders in autocratic regimes ‘learn’ from their partners (Buera et al. 2011) and decide to democratise, anticipating higher economic growth. Our setting does not allow us to distinguish between ‘demand’ and ‘supply’ drivers of democratisation. Yet, we offer different pieces of evidence consistent with a transmission mechanism that is potentially consistent with both channels.

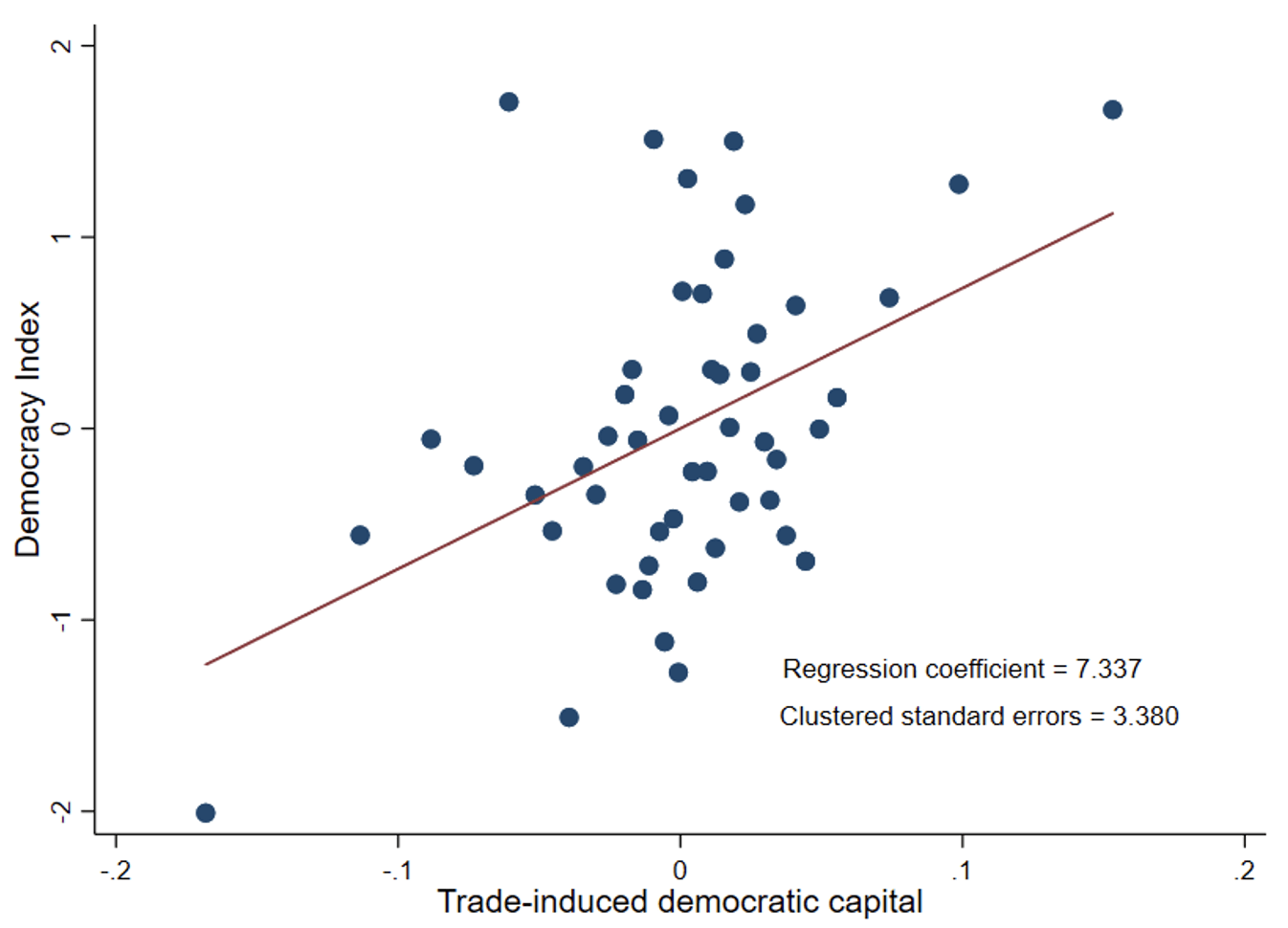

First, we construct a measure of ‘trade-induced’ democratic capital: for each country, we create a weighed democracy score, with weights equal to the trade shares of each partner. Figure 3 plots the relationship between own democracy score (y-axis) and trade-induced democratic capital (x-axis), holding constant country and year fixed effects, as well as democratisation waves occurring in a country’s neighbours (Acemoglu et al. 2019). In line with a transmission channel, the figure reveals a strong, positive relationship between own democracy and the trade-induced democratic capital. These results are stronger for less developed nations and are driven by countries that were not democratic as of 1960.

Figure 3 Trade-induced democratic capital and democracy

Source: adapted from Magistretti and Tabellini (2021). Democracy Index refers to the Polity2 score from the Polity IV project.

Second, we rely on data from the World Value Survey to measure individual attitudes towards democracy. Exploiting cross-cohort, cross-country variation in economic integration with democracies, we show that individuals who, during their ‘impressionable years’ (Giuliano and Spilimbergo 2009), were more exposed to economic integration with democratic partners are more likely to support democracy today, as compared to other individuals (from the same country) who grew up in periods of lower integration with democracies. These findings are consistent with those obtained in recent work by Acemoglu et al. (2021), who document that individuals are more likely to view democracy favourably if they were exposed to democratic institutions (within their own country) early on in their lives.

Finally, we test the hypothesis that the transmission of democratic capital might happen through the import of institutionally intensive goods, i.e. goods whose production crucially rests on sound contractual enforcement and strong property rights (Levchenko 2007, Nunn 2007), which are staple features of democracies. To do so, we leverage industry level-data to examine the ‘institutional content’ of trade. We provide evidence that non-democratic countries are significantly more likely to import institutionally intensive goods from democratic partners. In contrast, autocracies are unlikely to export complex and institutionally intensive goods – either to democracies or to other autocracies. These patterns, albeit qualitative, are again consistent with the idea that, through trade, citizens of less democratic countries get to know democracy and change their perceptions about it.

Taken together, our results suggest that economic integration, especially when it happens with democratic partners, fosters the spread of democracy. This is because mutual exchange and interactions between trade partners might favour a process of cultural and institutional transmission, whereby democratic capital flows from more to less democratic countries. One additional implication of our results is that economic integration might benefit less democratic countries not only directly, by fostering GDP growth (Frankel and Romer 1999, Donaldson 2015, Impullitti and Licandro 2018), but also indirectly, by favouring the transition to democracy, which can in turn be desirable for both socioeconomic and political reasons (Acemoglu and Robinson 2012, Acemoglu et al. 2014).

In our work, we cannot disentangle whether the transmission of democratic capital operates from the ‘bottom up’, with citizens of autocratic countries demanding the extension of the franchise (Acemoglu and Robinson 2006), or from the ‘top down’, with autocratic rulers learning from their partners (Buera et al. 2011) and spontaneously democratising. Our analysis also does not examine the effects of economic integration on the distribution of resources within societies. If the winners from trade support democratic institutions, we expect the transmission mechanism to be amplified. The opposite is likely to happen if trade benefits groups who are averse to the extension of the franchise. These are exciting topics for future research with important implications for trade policies.

Authors’ note: The views expressed herein are those of the authors and should not be attributed to the IMF, its Executive Board, or its management.

References

Acemoglu, D and J A Robinson (2006), Economic Origins of Dictatorship and Democracy, New York: Cambridge University Press.

Acemoglu, D and J A Robinson (2012), Why nations fail: The origins of power, prosperity, and poverty, Crown Books.

Acemoglu, S Naidu, J Robinson and P Restrepo (2014), “Democracy causes economic development?“, VoxEU.org, 19 May.

Acemoglu, D, S Naidu, P Restrepo and J A Robinson (2019), “Democracy does cause growth”, Journal of Political Economy 127(1): 47-100.

Acemoglu, D, N Ajzenman, C G Aksoy, M Fiszbein, and C Molina (2021), “(Successful) Democracies Breed Their Own Support,” VoxEU.org, 15 September.

Anderson, J E and E Van Wincoop (2003), “Gravity with gravitas: a solution to the border puzzle”, American Economic Review 93(1): 170–192.

Besley, T and T Persson (2019), “Democratic values and institutions”, American Economic Review: Insights 1(1): 59-76.

Buera, F J, A Monge-Naranjo, and G E Primiceri (2011), “Learning the wealth of nations”, Econometrica 79(1): 1–45.

Colantone, I and P Stanig (2017), “Globalisation and economic nationalism“, VoxEU.org, 20 February.

Donaldson, D (2015), “The gains from market integration”, Annual Reviews of Economics 7(1): 619-647.

Donaldson, D (2018). “Railroads of the Raj: Estimating the Impact of Transportation Infrastructure,” American Economic Review 108(4-5): 899-934.

Eichengreen, B and D Leblang (2008), “Democracy and Globalization,” Economics&Politics 20(3): 289-334.

Feyrer, J (2019), “Trade and income—exploiting time series in geography,” American Economic Journal: Applied Economics 11(4): 1-35.

Frankel, J A and D Romer (1999), “Does trade cause growth?”, American Economic Review 89(3): 379–399.

Freedom House (2020), Freedom in the World 2020.

Frieden, J (2019), “The Backlash Against Globalization and the Future of the International Economic Order”, in P Diamond (ed.) The Crisis of Globalization: Democracy, Capitalism, and Inequality in the Twenty-First Century, B. Tauris.

Glaeser, E , G A Ponzetto and A and Shleifer (2007), “Why does democracy need education?”, Journal of Economic Growth 12(2): 77-99.

Hummels, D (2007), “Transportation costs and international trade in the second era of globalization”, The Journal of Economic Perspectives 21(3): 131–154.

Impullitti, G and O Licandro (2018), “Quantifying the gains from trade“, VoxEU.org, 29 April.

Levchenko, A A (2007), “Institutional quality and international trade.” The Review of Economic Studies 74(3): 791-819.

Lipset, S M (1959). “Democracy and working-class authoritarianism”, American Sociological Review, 482-501.

Lopez-Cordova, J E and C M Meissner (2008) “The Impact of International Trade on Democracy: A Long-Run Perspective,” World Politics 60(4): 539-575.

Magistretti, G and M Tabellini (2021). “Economic Integration and Democracy: An Empirical Investigation”, Working Paper.

Nunn, N (2007). “Relationship-specificity, incomplete contracts, and the pattern of trade”, The Quarterly Journal of Economics 122(2): 569-600.

Pascali, L (2017). “The wind of change: Maritime technology, trade, and economic development”, American Economic Review 107(9): 2821-54.

Persson, T and G Tabellini (2009). “Democratic capital: The nexus of political and economic change”, American Economic Journal: Macroeconomics 1(2): 88–126.

Przeworski, A, R M Alvarez, M E Alvarez, J A Cheibub, F Limongi, and F P L Neto (2000), Democracy and development: Political institutions and well-being in the world, 1950-1990, Cambridge University Press.

Rodrik, D (2017), “Economics of the populist backlash“, VoxEU.org, 3 July.

Spilimbergo, A and P Giuliano (2009), “The long-lasting effects of the economic crisis“, VoxEU.org, 25 September.

Walter, S (2021). “The Backlash Against Globalization”, Annual Review of Political Science 24: 421-442.

This blog post is part of a series by the voxeu.org