globalbizmag.com

Global Islamic Assets Set to Reach $6.7 Trillion by 2027

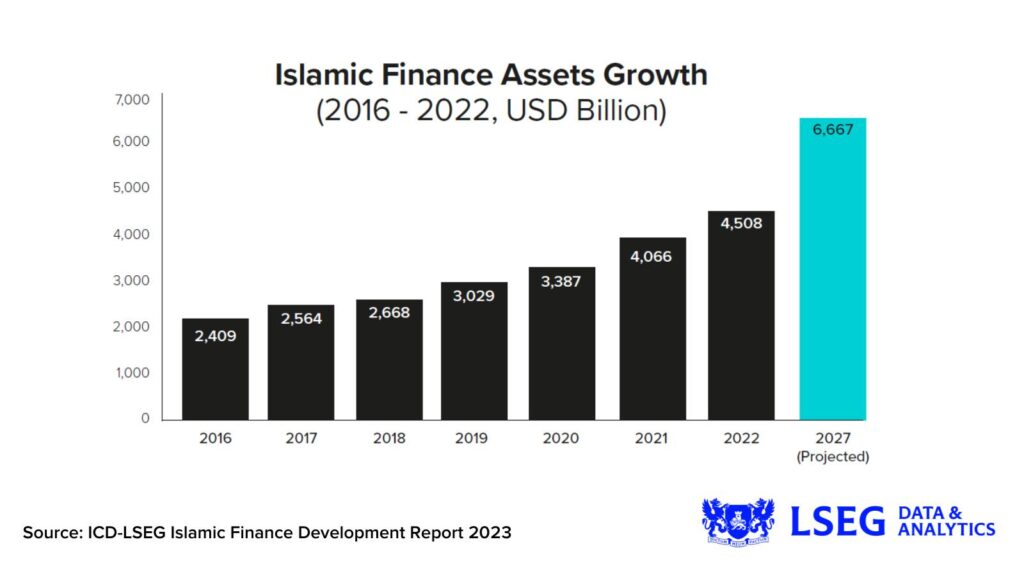

The global Islamic finance industry has increased its assets size by 11% to $4.5 trillion in 2022 and the Islamic assets are forecast to grow to $6.7 trillion by 2027, according to the ICD-LSEG Islamic Finance Development Report 2023.

According to the findings of the report entitled “Navigating Uncertainity,” the Islamic finance industry transformed from a niche market to mainstream in many countries, demonstrating how a small sector can grow to become a large standalone industry in the past decade.

The report was authored jointly by Shaima Hasan, Senior Proposition Manager and Shereen Mohamed, Senior Research Analyst at the UK-based London Stock Exchange Group (LSEG), which is one of the world’s leading providers of financial markets infrastructure and delivers financial data, analytics, news and index products.

“This growth reflects a healthy industry driven by strong balance sheets, high profits, regulator support and sustained demand by both customers and investors across different regions,” The report said.

Several key factors contribute to this outlook, including the large Islamic finance markets such as the GCC region, Malaysia and Indonesia continuing to strengthen their domestic Islamic finance industries, and Pakistan addressing the requirements to convert its financial system to become interest-free following its Federal Shariah Court judgement on Riba, a concept in Islamic banking that refers to charged interest in 2022.

In other parts of the world such as West African nations, different jurisdictions are working towards embracing the Islamic finance industry further through regulations.

In the last decade, regulators and governments have continued to strengthen Islamic finance regulations, growth strategies and comprehensive roadmaps to develop the industry and its ecosystem.

Many jurisdictions developed long-term strategies, invest in human capital and education, organise industry events and publish dedicated reports. Some, such as Indonesia, Malaysia, Saudi Arabia and Türkiye, even added Islamic finance metrics as part of their national economic strategies and blueprints. These initiatives bore much fruit in the form of double-digit growth rates in assets in the past few years.

Islamic Banking Assets

The assets of the world’s Islamic banks expanded rapidly to reach $3.24 trillion by end of 2022 up from $1.3 trillion by 2012. The number of full-fledged Islamic banks rose by 36% to 336 in 2022 while conventional banks with Islamic windows or services increased by 84% to 274 in 2022.

“The highest growth in Islamic banking in the past decade was in Saudi Arabia, the UAE and Iran that capitalised on improvement of its local currency in the early years,” the report said.

Holding around 70% share of global Islamic financial assets, Islamic banking was the main driver of the overall growth of the industry in the last ten years. Islamic banks stayed resilient through market volatilities from 2012 to 2022, pertinently recovering from the intense stress inflicted on them during the COVID-19 pandemic and economic uncertainties post-2020 that prompted investors to push more capital and investments towards Islamic banking institutions.

During the decade, more countries welcomed Islamic banks– significantly Oman was the last GCC country to adopt Islamic finance–while others, such as Qatar, closed Islamic windows.

“Outside the GCC, countries in other regions also started focusing more on Islamic banking, with the prime examples being Turkiye, the Central Asian countries such as Kazakhstan and Uzbekistan, Nigeria and Uganda in Sub-Saharan Africa, and the Philippines in Southeast Asia,” the report said.

Even the governments began working towards consolidation to to create mega banks with international reach and there were many mergers and acquisitions within the banking sector in key Islamic finance markets, including the UAE, Indonesia, Malaysia, Bahrain, Kuwait, and Saudi Arabia, among others.

In addition, the mainstream Islamic finance started attracting conventional financial institutions. For example, conventional banks established Islamic subsidiaries in Morocco and Oman and more insurance operators opened Takaful windows in Pakistan.

FinTech, digital banking and artificial intelligence (AI) were some of the key developments that had material impacts on the development of Islamic banking in the decade leading up to 2022. Many new digital banks were opened in countries like Malaysia and Indonesia in Asia, Bahrain, Saudi Arabia and, Turkiye in the Middle East, and the UK in Europe.

Sukuk Gains

The global sukuk instruments total value stands at $788.39 billion by 2022 compared with $260.03 billion by 2012 while total number of sukuk outstanding count to 4,806 up from 1,899 in 2012. Issuance from both international and domestic markets has reached a record number in recent years where 1,458 number of sukuk issued in 2022 with a value of $198.82 billion compared with 878 in 2012 valued around $142 billion.

The development of the Sukuk market was primarily driven by the ever-growing need for funding. Additionally, the wider investor base also caught on to the attractiveness of the instrument, partly due to its scarcity, and partly because of its unique mixed features straddling equity and fixed income.

Many governments and corporates tapped the niche market despite the instrument’s complex structures and procedures relative to conventional bonds. Since 2002 when the first Sukuk was issued during this modern Islamic finance period, growth has primarily been centred in traditional Islamic finance markets.

“However, in the past decade, issuers from different countries in Europe, Asia and Sub-Saharan Africa entered the Sukuk market to contribute to its diversification and depth. Despite growth, the development of the Sukuk market was limited by fewer issuances compared to conventional bonds,” the report said.