Image Credits : unsplash.com

Gold Most Sought After Asset by Central Banks Across the World

The yellow metal will never lose its sheen and an increasingly complex geopolitical and financial environment is making gold reserves management more relevant than ever, according to the 2024 Central Banks Gold Survey, conducted by World Gold Council.

The survey said that in 2023, the Central Banks across the world have added 1,037 tonnes of gold – the second highest annual purchase in history – following a record high of 1,082 tonnes in 2022, thus indicating that gold continues to be viewed favourably by central banks as a reserve asset.

According to the survey, which was conducted between 19 February and 30 April 2024 with a total of 70 responses, 29% of the Central Banks’ respondents intend to increase their gold reserves in the next twelve months, the highest level the World Gold Council has observed since it began this survey in 2018.

“The planned purchases are chiefly motivated by a desire to rebalance to a more preferred strategic level of gold holdings, domestic gold production, and financial market concerns including higher crisis risks and rising inflation,” the survey revealed.

The survey results come amidst a backdrop of ongoing geopolitical tensions – conflict in the Middle East, a protracted war in Ukraine and elevated US-China tensions.

On the macroeconomic front, while global inflation is starting to cool, economic recovery is proceeding at an uneven pace around the world and concerns loom regarding underlying financial vulnerabilities.

Accordingly, “interest rate levels,” “inflation concerns,” and “geopolitical instability” continue to be the leading factors in the Central Bankers’ reserve management decisions as they were last year, the survey findings said.

Future of USD

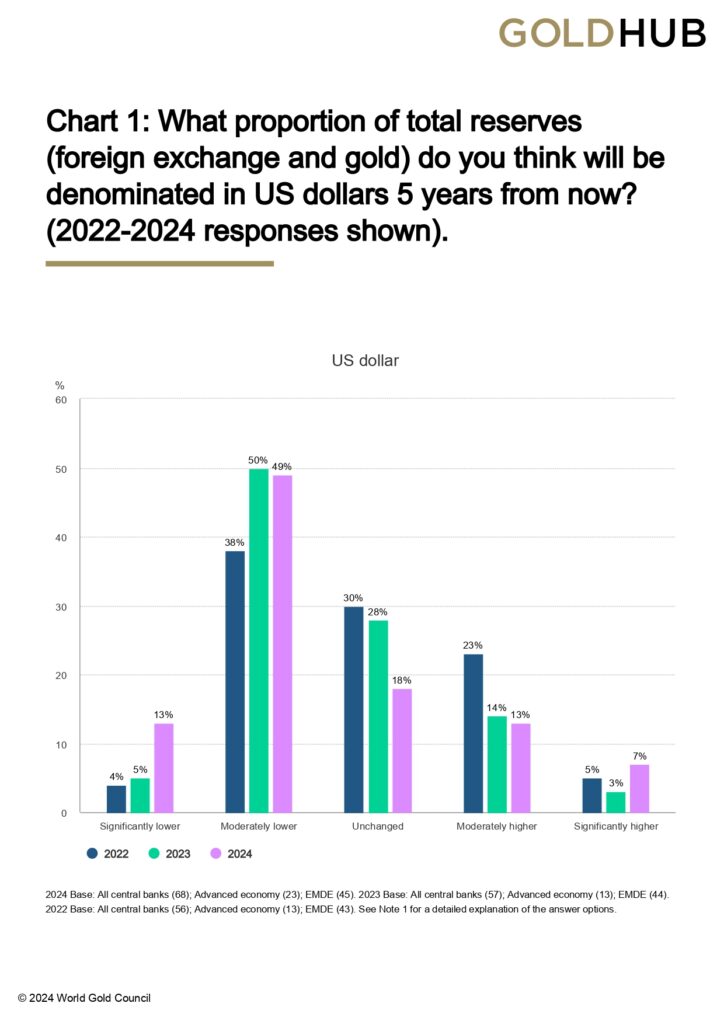

In a continuation of a trend observed in last year’s survey, the view of the US dollar’s future proportion of total reserve assets has continued to decline, with 62% of respondents thinking that the dollar’s share will diminish five years from now, up from 55% in 2023 and 42% in 2022 (see chart).

There continues to be a gulf in thinking between advance economy and Emerging Market and Developing Economy (EMDE) central banks on this question, however. Whereas 30% of advanced economy respondents think the US dollar’s share of global reserves will remain unchanged five years from now, only 11% of EMDE respondents share this view.

While 56% of advanced economy respondents believe the US dollar’s share of global reserves will fall, 64% of EMDE respondents believe it will do so.

It is notable though that the percentage of advanced economy respondents who believe that the US dollar’s share of global reserves will fall has increased from 46% in 2023 to 56% in 2024 – reflecting increased pessimism even among advanced economy respondents about the US dollar’s future share of global reserves.

Overall, central banks view gold’s prospects as a reserve asset over the next twelve months slightly more favourably than last year, with 81% saying that global central bank gold holdings will rise in the next twelve months compared to 71% last year.

Compared to last year, a slightly higher proportion of respondents (29%) say they have plans to increase their own gold holdings in the next twelve months, the survey findings said.