Huge Investments Driving Growth in GCC Region

Despite an unsettled political backdrop, rapid levels of investment are driving growth in the Gulf Cooperation Council (GCC) as countries look to diversify away from conventional energy and Giga-projects have been attracting global talent, while stretching supply chain capacity.

In its “International Construction Market Survey 2024,” Turner & Townsend, a multinational professional services company headquartered in the UK, said that with central bank interest rates beginning to fall from the highs of previous years, state-backed developments and giga-projects as part of various nation-building initiatives are continuing to drive construction activity across GCC member-states.

Furthermore, there has been a marked increase in construction in sports, leisure and hospitality in Saudi Arabia and the UAE, the two leading economic power houses in the Arab world, the survey showed.

According to the IMF’s World Economic Outlook, GDP in the Middle East region is forecast to rise by 2.8% in 2024 and 4.2% in 2025 – representing a positive trajectory, especially relative to other emerging markets. This has been buoyed by the huge number of opportunities in major mixed-use, sports, leisure and residential development.

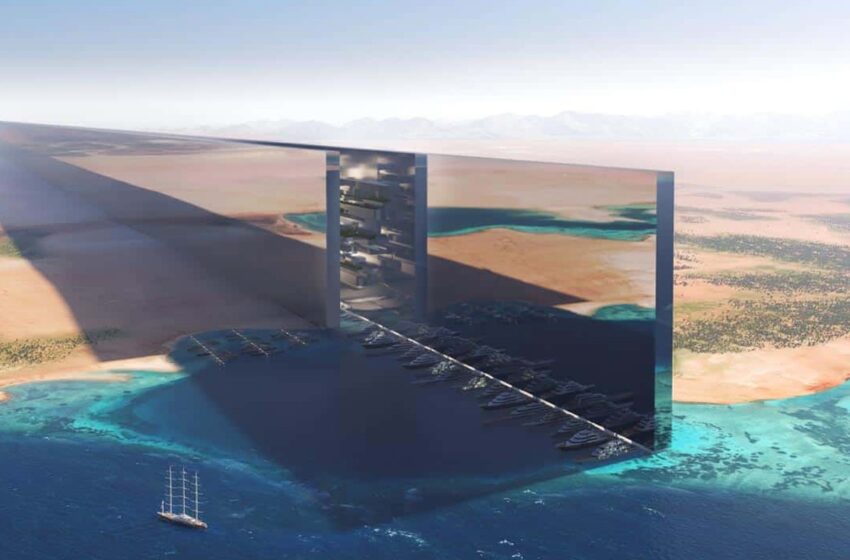

Saudi Arabia has been ranked as the world’s 19th most expensive country to build in, has seen remarkable investment as both domestic and foreign funds look to capitalise on state-backed initiatives such as $500 billion NEOM city and the Government’s wider 2030 vision.

This has led to a growth of the major mixed-used development sector as schemes like The Line, King Salman Park and Diriyah Gate begin to take shape.

The Kingdom is also gearing up for EXPO 2030 and the 2034 FIFA World Cup by building in the necessary capacity, while also making overtures to global corporate occupiers through its Regional Headquarter Programme.

This scheme encourages companies to launch offices in Saudi Arabia and there are cost advantages to office investment with an average high-rise central business district office in Riyadh costing a relatively low $2,266 per sq m.

The UAE has been a hotspot for tourism in the region in recent years and its relatively low cost of construction, when compared with Western markets, still makes it an attractive place to build the hubs and amenities for international visitors.

In Dubai, residential development is buoying the local market as the city aims to support its growing population. Its attractiveness as a market is bolstered by its comparably low cost of construction with high-rise apartment buildings costing $1,334 per sq m, the survey said.

Data Centres

Data centres are an emerging sector – owing to the vast areas of land, easy access to financing and increasing demand for digital infrastructure as the Middle East expands. Across the Middle East, however, there are factors that are restraining its collective plans.

Saudi Arabia is facing a distinct shortage of skilled labour that is vital in delivering the country’s giga-projects.

“The draw of activity in the Kingdom contrasts with a comparable softening of market conditions in other regional capitals. As a result of this easing of demand, average labour prices in Doha have fallen slightly over the past year, with the overall rate of construction cost inflation lessening from 3.5% in 2023 to 2.5% in 2024,” the survey said.

Abu Dhabi has felt a similar phenomenon, seeing its own average labour costs nudge down slightly and its rate of overall construction cost inflation plateauing.

Innovation in Procurement Helps

Innovation in procurement is one route to addressing bottlenecks by attracting a wider pool of contractors into a market that remains dominated by larger firms.

Overall, there is a need for clients to think strategically about supply chains and investments and to integrate greater collaboration in their contracting models.

With inflation expected to come down and capacity potentially levelling out, there may be a more balancing of activity across the region. Even still, businesses should be thinking about how they can get more from less through advanced techniques and digital strategies.