globalbizmag.com

Money Transfer from UAE to Egypt Surges, says Al Ansari Exchange

Al Ansari Exchange, the largest remittance and foreign exchange company in the UAE, and a subsidiary of Al Ansari Financial Services Group, on Tuesday announced that there was a remarkable increase in the volume of money transfers sent from the UAE to Egypt following recent developments related to the Egyptian Pound exchange rate.

The company highlighted a significant rise in the number of financial transfers to Egypt since the Central Bank of Egypt announced last Wednesday (6 March 2024) the decision to float the Egyptian Pound and liberate its exchange rate according to market mechanisms.

Al Ansari Exchange emphasised that this decision is highly beneficial to Egyptians residing in the UAE, it said in a disclosure to Dubai Financial Market (DFM), where its shares are traded.

Ali Al Najjar, Chief Operations Officer at Al Ansari Exchange, said that the recent decision of the Egyptian Central Bank to liberalise the exchange rate of the pound, allowing it to be determined according to market mechanisms has had a significant impact on financial transfers from the UAE to Egypt.

“Al Ansari Exchange reaffirms its commitment to continue providing financial transfer services with the highest standards of reliability and efficiency, enabling residents to support their families and contribute to enhancing financial inclusion, prosperity, and the growth of the Egyptian economy,” he added.

It may be recalled that Egypt is one of the most active corridors for financial transfers from the UAE, ranking fifth after India, the Philippines, Pakistan, and Bangladesh in terms of the total number of transfers sent to individuals from the UAE.

Image courtesy: Now Money

Top Recipients

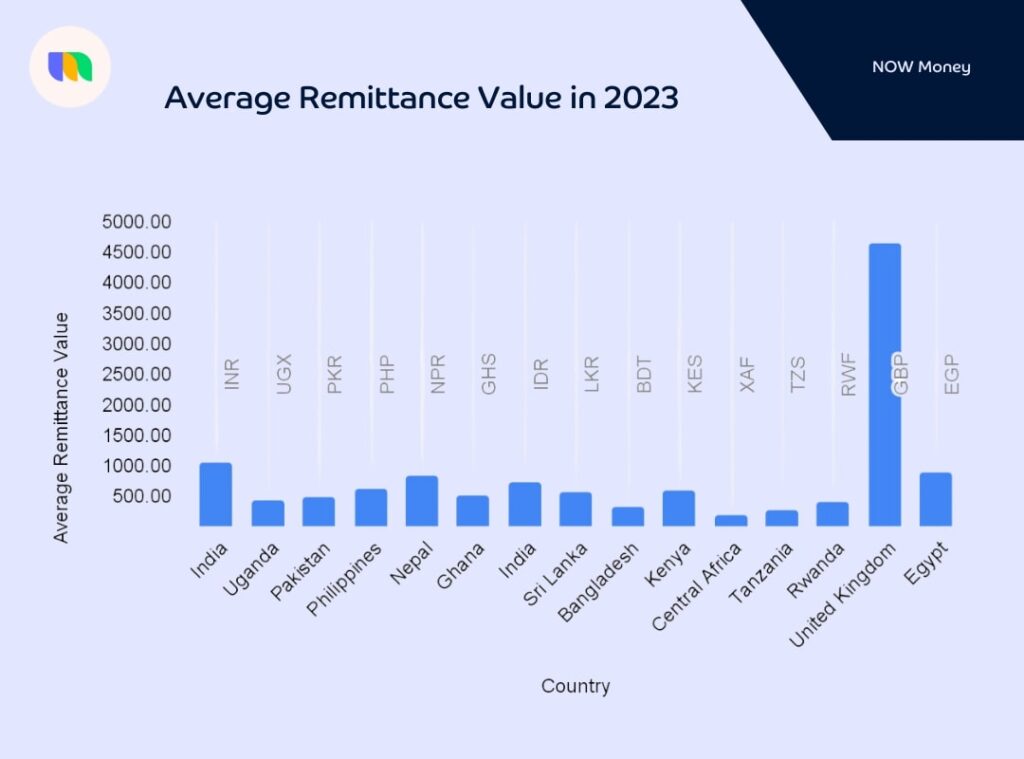

In terms of average remittance value, the top five highest recipient of remittances from the UAE in 2023 are the UK (1.26 billion), India ($288.6 million), Egypt ($246.4 million), Nepal ($227.25 million) and Indonesia ($200 86 million), according to Now Money, the UAE’s first digital payroll and mobile bank service developed specifically for low income workers.

On the other hand, the countries receiving the lowest average remittance value were Central Africa ($56.06 million), Tanzania ($76.92 million), Bangladesh ($87.63 million), Rwanda ($114.18 million) and Uganda ($119.11 million), Now Money said.

The top performers for Lulu Exchange were India, Pakistan, Sri Lanka, Egypt, and Nepal while Qatar, Bangladesh, Pakistan, Egypt, Nepal, India, and Philippines were the top performers for Al Ansari.

“Our 2023 research shows that remittance value in Egypt and Sri Lanka have continued to grow just as these two exchange houses noted at the end of 2022. More importantly, our research agrees that Asia and Africa are the two fastest-growing corridors with Indonesia and Sri Lanka representing Asia and Egypt, Rwanda, and Ghana representing Africa,” Now Money added.