Quantitative easing and conventional monetary policy have similar side effects

Quantitative easing is often criticised due to side effects on asset price valuation and risk taking. This column compares the financial side effects of conventional monetary policy to those of quantitative easing, based on the amount of inflation generated by each policy. A systematic comparison of multiple measures of financial side effects for the euro area, the UK, and the US suggests that the side effects of quantitative easing and conventional monetary policy are roughly the same.

Should monetary policy take the financial side effects of quantitative easing (QE) into account? In this column, we argue that any such side effects need to be compared against the side effects of conventional monetary policy, the tool central banks rely on away from the effective lower bound (ELB). We discuss the rationale behind this approach and summarise the evidence from our recent research on which instrument has larger side effects.

Several public institutions have recently criticised QE policy directly. The UK House of Lords pointed to several important knowledge gaps and argued that the policy had benefitted “wealthy asset holders disproportionately by artificially inflating asset prices”. Similarly, in a landmark ruling in May 2020, the German constitutional court expressed concerns that the ECB did not take into account proportionality in its QE decisions. These criticisms are based on the synthesis of expert opinion, whose basis was not always clear but which we must hope was founded in empirical evidence.

Our view is that these reports into QE focus on the wrong question. Any monetary policy, including changes in the short-term rate, has some financial side effects, as documented by a large body of previous research (e.g. Bean 2015). The question asked should therefore not be if QE has side effects, but rather whether these are smaller or larger than those associated with conventional monetary policy. Would asset prices and risk-taking have behaved differently if central banks had been able to ease policy in the past decade via the short-term rate instead?

To our knowledge, no previous research addresses this important question. Our recent paper (Weale and Wieladek 2021) is the first work explicitly to test whether the financial side effects of QE differ from those of the short-term interest rate. Following previous work for conventional monetary policy, we examine the effects on private credit imbalances (Sá et al. 2011), financial market risk (Rey 2013), and asset valuation (Faria and Verona 2018). We adopt an agnostic Bayesian VAR approach, identifying QE and conventional monetary policy shocks with four different identification schemes and two different measures of unconventional monetary policy, the asset purchase announcement series in Weale and Wieladek (2016) and the shadow short-term rate series in Wu and Xia (2016). Our analysis covers the euro area, the UK, and the US.

Economic theory suggests that both QE and conventional monetary policy can have financial side effects. Borio and Zhu (2008) propose the risk-taking channel of monetary policy due to low short-term interest rates. The associated search for yield is likely to lead to lower yields on sovereign bonds, and to higher leverage raising asset prices. As QE is believed to work both through the portfolio rebalancing and the signalling channel, similar search-for-yield effects are likely to apply.

Comparing financial side effects across policies is not straightforward. However, the central banks in these monetary zones all targeted inflation during these time periods. The question we therefore seek to answer in our paper is: suppose the Bank of England, ECB or Fed had been able to achieve the same level of inflation, their primary target, by means of interest rate cuts. Would asset prices have increased by more or by less than they did as a result of QE?

To answer the question above, we standardise all of the impulse responses of the financial and credit variables by the CPI response during the sample period when the short-term rate was the main instrument. We repeat the same exercise for impulse responses during the sample period when QE was the main instrument. We then compare the distribution of impulse responses of private credit imbalances, financial market risk, and asset valuation for each percentage point of inflation these different monetary policies generate. This approach allows us to assess whether financial side effects of QE differ from those of conventional monetary policy and whether the difference is statistically significant or not.

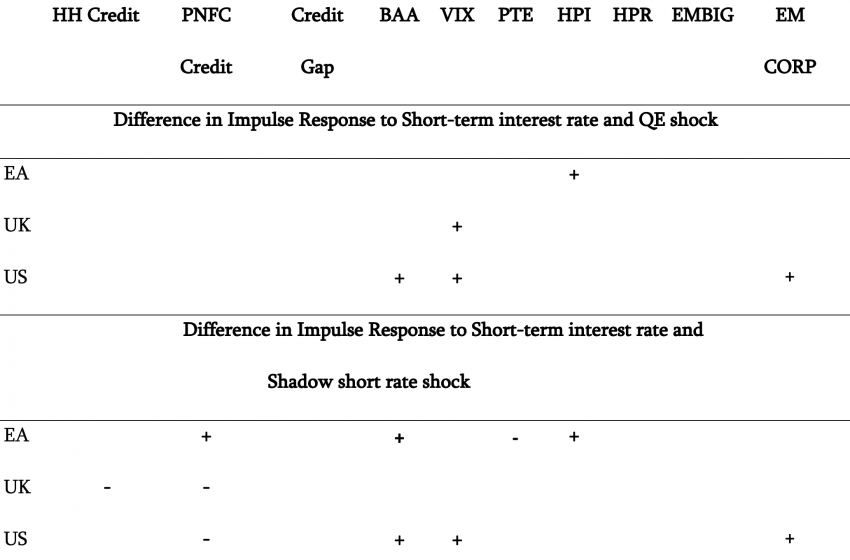

Table 1 shows our results. For most variables, there is no statistically significant systematic pattern whereby QE has a greater effect than conventional monetary policy. The only statistically significant differences across measures of unconventional monetary policy is for the VIX, BAA spread, and the emerging market corporate bond spread in the US. Here, there is evidence that conventional monetary policy has had a larger effect than QE for each percentage point of inflation generated by these policies. In the euro area, conventional monetary policy has a stronger effect than QE on the house price-to-income ratio.

Table 1 Impulse responses of financial variables to various monetary policies

Note: ‘+’/ ‘-‘ indicates that the difference in impulse response is positive/negative and statistically significant across at least three of the four proposed identification schemes. HH Credit is credit to the household sector to GDP ratio, PNFC Credit is credit to the PNFC sector to GDP ratio, Credit gap is the BIS Credit gap to GDP ratio, BAA the BAA to AAA spread on corporate bonds, VIX the VIX, PTE the equity price to equity ratio, HPI/HPR the House Price to Income/ House Price to rent ratios.

Our tentative conclusion from this research is that QE and conventional monetary policy have roughly similar side effects. If anything, there is some evidence that the effects of conventional monetary policy on financial market risk spreads are stronger than those of QE.

In other words, these results suggest that had central banks been able to rely on the short-term rate to ease monetary policy in the past decade, the effects of interest rate reductions would have been similar to those from QE. This implies that current asset prices imbalances are perhaps not due to any particular monetary policy instrument, but more probably due to weak demand and a low natural rate of interest, which required such a large degree of monetary easing in the past decade.

Of course, these findings, like any empirical study at the economy-wide level, are subject to a number of caveats. Our conclusions may be overturned by future work. There is now a significant amount of data on QE because the policy was introduced more than ten years ago. Questions around the costs and benefits of QE continue to dominate the debate in central banks. We hope that this work will inspire more future papers to explore this important question in greater depth.

References

Bean, C (2015), “Causes and Consequences of Low Interest Rates”, VoxEU.org, 23 October.

Borio, C and H Zhu (2008), “Capital Regulation, Risk-taking and Monetary Policy: A Missing Link in the Transmission Mechanism”, BIS Working Paper No 268.

Faria, G and F. Verona (2018), “The yield curve and the stock market: Mind the long run”, VoxEU.org, 9 May.

Rey, H (2013), “Dilemma not Trilemma: The global financial cycle and monetary policy independence”, VoxEU.org, 31 August.

Sa, F, P Towbin and T Wieladek (2011), “Low interest rates and housing booms: The role of capital inflows, monetary policy, and financial innovation”, VoxEU.org, 10 March.

Weale,M R and T Wieladek (2016), “What are the Macroeconomic Effects of Asset Purchases?”, Journal of Monetary Economics 79: 81-93.

Weale, M R and T Wieladek (2021), “Financial ‘Side Effects’ of QE and Conventional Monetary Policy Compared”, CEPR Discussion Paper No 16395.

Wu, J and F D Xia (2016), “Measuring the Macroeconomic Impact of Monetary Policy at the Zero Lower Bound”, Journal of Money, Credit and Banking 48: 253-291.

This blog post is part of a series by the voxeu.org