Saudi Banks Report 3.7% growth in L&A in Q3-2024

Driven by a 4.4% rise in corporate and wholesale banking, Saudi Arabia’s ten largest banks have reported a 3.7% q-o-q increase in Loans & Advances (L&A), while deposits grew by 1.4% q-o-q, led by a 4.2% increase in time deposits, according to leading global professional services firm Alvarez & Marsal (A&M).

In its latest report entitled “KSA Banking Pulse for Q3 2024,” A&M said that operating income rose by 6% q-o-q to $9.82 billion in the third quarter primarily due to a 15.2% growth in non-interest income (NII) to $2.29 billion, despite a slight 3.5% increase to $7.53 billion in net interest income. Other operating income (+32.7% q-o-q led the growth in non-interest income.

The impairment charges increased moderately by 30.4%, while net income grew by 4.5 percent q-o-q, the report said.

The term deposits witnessed the highest growth at 4.2% qo-q. Consequently, the loans-to-deposit ratio (LDR) increased by 2.3 percentage points q-o-q to 100.1 percent in the third quarter of 2024, the report said.

The report also said that aggregate net interest margin (NIM) remained stable at 2.95% in Q3 of 2024. Yield on credit increased by 18 basis points q-o-q to 8.6%, while the cost of funds increased by 14 basis points q-o-q to 3.5%.

Cost-to-income ratio improved by 31 basis points q-o-q to reach 31% in the third quarter. This was due to a higher rise in operating income (+6% q-o-q) compared to operating expenses (+4.9% q-o-q), the report said.

The cost of risk worsened by 7 basis points q-o-q to settle at 0.35% in Q3 of 2024 compared with 0.28% in the previous quarter. All the top four banks witnessed a worsening in the cost of risk.

The aggregate net profit of Saudi Arabia’s banks increased by 5.3% q-o-q to $5.46 billion in the third quarter due to non-interest income growth (+15.2% q-o-q), resulting in a 6% q-o-q growth in total operating income. The increase in net income resulted in RoE expanding to 17.4% (+0.6 percentage points q-o-q) while RoA remained consistent at 2% for the quarter.

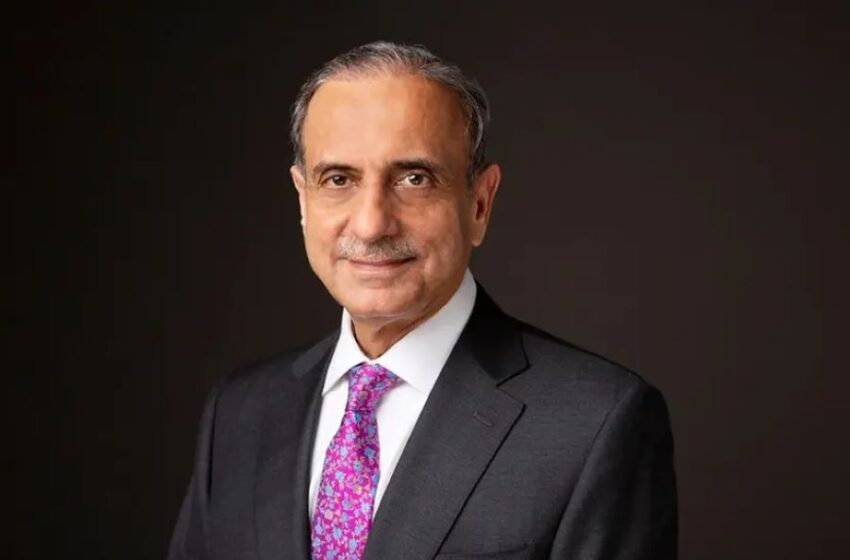

Asad Ahmed, A&M Managing Director, Financial Services said that the continued positive performance in the third quarter of 2024 reflected a balance of growth and improved cost efficiencies among Saudi Banks. Profitability has increased primarily due to an increase in non-interest income amid a moderate rise in impairment charges.

“As the Saudi Central Bank (SAMA) maintains interest rates in line with the US FED, potential further rate cut in the coming quarters are likely to affect interest margins.; Focus on non-interest income and improved cost efficiencies, will remain central going forward,” he added.

New Entrants

Saudi Arabia’s Central Bank (SAMA) has licensed ‘BOUABA TSHIL’ company to provide consumer microfinance solutions taking the total number of consumer microfinance companies in the Kingdom to six.

SAMA also signed an agreement with Samsung to enable the launch of Samsung Pay in Saudi Arabia during this month while fintech player ‘Barq’, led by former STC Pay CEO, launched an app to transfer money to more than 200 countries and Visa cards.