globalbizmag.com

Saudi’s Top 10 Banks Performed Robust and Positively in 2023

The performance of top 10 listed banks in Saudi Arabia remained largely robust and positive as the operating income grew by 9.5% reflecting the effect of higher Non-Interest Income (NII), global professional services firm Alvarez & Marsal (A&M) said on Monday.

These 10 banks include Saudi National Bank (SNB), Al Rajhi Bank, Riyad Bank (RIBL), Saudi British Bank (SABB), Banque Saudi Fransi (BSF), Arab National Bank (ANB), Alinma Bank, Bank Albilad (BALB), Saudi Investment Bank (SIB) and Bank Aljazira (BJAZ).

In its fourth annual edition of the Kingdom of Saudi Arabia (KSA) Banking Pulse for fiscal year 2023, the firm noted that the year also saw NIMs improving by 3.5% with both the cost-to-income ratio (C/I) and the COR showing improvement.

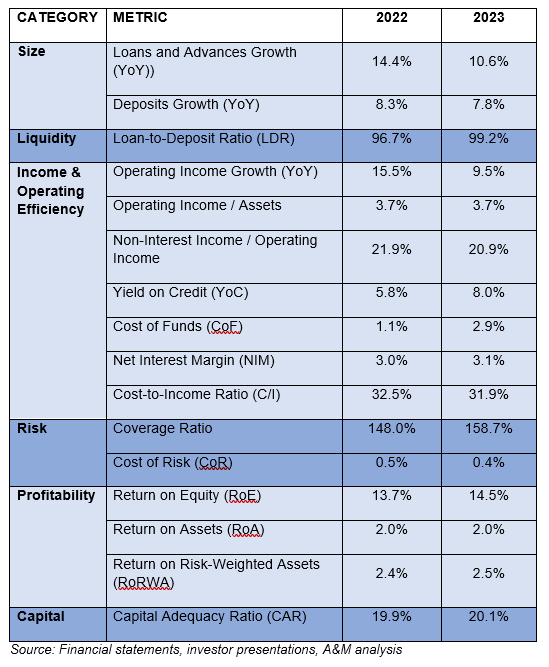

“Overall, return on equity (ROE) increased to 14.5% while return on assets (ROA) stayed constant at a healthy 2%. Looking ahead, we expect the outlook for Saudi banks to remain stable to positive,” the firm said in the report.

The financial year 2023 witnessed liquidity coming under relative pressure as loan growth outpaced deposit growth amidst the high interest rates. During the year, government related entities (GRE) deposits reached a record high at 31.2% as against 28.4% in 2022, of total bank deposits in the country.

“This accounted for 68.2% of the total deposit increase in 2023 resulting in increase in money supply in the economy helped moderate the liquidity conditions in the Saudi Arabian banking system,” the report noted.

NIM expanded marginally to 3.1% as the yield on credit (YoC) expanded (+2.1% y-o-y) more than cost of funds (CoF) (+1.8% y-oy). The slower pace of differential loan growth in comparison to deposit growth came as Saudi Central Bank (SAMA) increased the policy rate.

The KSA Banking Pulse also examined data of the 10 largest listed banks in the Kingdom, comparing the 2023 financial results with those of previous year. Using independently sourced published market data and 16 different metrics, the report assessed banks’ key performance areas, including size, liquidity, income, operating efficiency, risk, profitability, and capital.

L&A Outpace Deposit Growth

Loans & advances (L&A) growth outpaced the deposits growth in 2023. Aggregate L&A for top 10 banks grew at 10.6% y-o-y whereas aggregate customer deposits increased by 7.8% y-o-y in 2023. Consequently, loan-to-deposit ratio (LDR) increased 2.5% y-o-y to 99.2%.

The total operating income increased by 9.5% y-o-y as compared with 15.4% in 2022. The growth in operating income was primarily driven by NII which increased by 10.9% and non-funded income which increased by 4.3% in 2023. Of all these 10 banks, SABB reported significant increase of 31.7% y-o-y in operating income due to substantial increase in net interest income (+39.6%).

Cost-to-income (C/I) ratio improved by 0.6% points to 31.9% in 2023. The operating income reported growth of 9.5% whereas the operating expense grew at a slower rate of 7.5%. In all, seven out of the ten listed banks witnessed improvement in C/I ratio.

Asad Ahmed, Managing Director and Head of Middle East financial services at A&M said that the report underscored the stability and growth potential of the Saudi banking sector, which has shown remarkable operating income growth and an uptick in return on equity.

He said that despite some challenges in the economic landscape, the industry has adeptly navigated through, leveraging favourable credit conditions and their analysis reflected the sector’s enduring stability and promising upward trajectory, reinforcing our optimism for its future.

“Considering Saudi’s Vision 2030, the Kingdom’s banking sector is expected to play a central role in achieving its objectives. Moving forward, we expect positive outlook for KSA banks with, prospective loan growth, improving asset quality and well capitalised books. Given the upcoming scenario of interest rate cuts by the second half of 2024, we anticipate that NIMs will remain stable at around 3% during the year,” he added.