Switch Completes $3.5 Billion Securitised Financing Deals

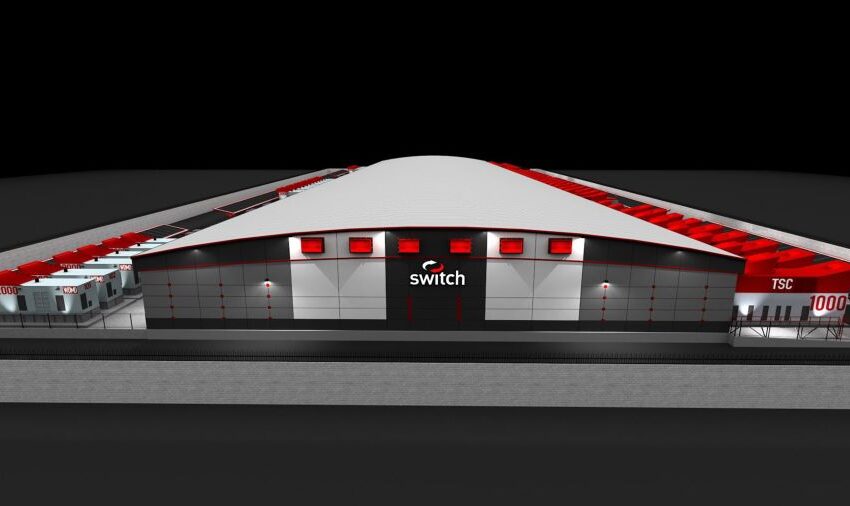

The Las Vegas-headquartered Switch, a premier provider of AI, cloud and enterprise data centers to most discerning clients, on Wednesday announced the successful completion of two securitised financing transactions totalling $3.5 billion.

The transactions include a $2.4 billion Single Asset Single Borrower (SASB) CMBS loan and a $1.1 billion Asset Backed Security (ABS) issuance. The combined proceeds will refinance the majority of the company’s outstanding acquisition financing, which supported the take-private transaction led by DigitalBridge and IFM Investors in December 2022.

Switch President Thomas Morton said that the completion of two landmark transactions – the third ABS and inaugural CMBS issuances – of new securitized debt, bringing the company’s total issuance over the past 12 months to more than $5.2 billion.

These two transactions, which Switch has successfully closed only one month apart, makes the company the largest issuer of securitised data center paper during the past year, he explained.

The CMBS issuance of $2.4 billion is the largest green data center CMBS transaction ever completed, and the second largest data center CMBS transaction in history. The ABS offering of $1.1 billion, the largest green data center transaction ever completed, is the third in their master trust which now totals $2.8 billion.

Switch’s Chief Financial Officer Madonna Park said that both of these transactions mark significant milestones in repaying their acquisition financing and the timing highlighted the resiliency of the Switch platform and the company’s ability to access the capital markets at scale.

“New and existing investors continue to show strong interest in our differentiated assets and business model, and we plan to remain a repeat issuer,” she added.

CMBS Deal

Switch’s inaugural CMBS transaction includes its Las Vegas 7, Las Vegas 9 and Reno 2 data centers and the $2.4 billion offering includes 66 unique investors across seven tranches. All series of notes in this CMBS issuance were designated as green bonds and received second-party opinion (SPO) from Sustainalytics.

ABS Transaction

Switch closed its third ABS issuance on 13 March 2025, for a little over $1.09 billion and this deal includes its Las Vegas 10 and Las Vegas 11 data centers. The offering was structured to include two classes of notes.

All series of notes in this issuance were designated as green bonds under International Capital Markets Association (ICMA) green bond principles in accordance with Switch’s Green Financing Framework. The deal was led by Morgan Stanley and TD Securities (USA) LLC as Co-Structuring Advisors.

In addition to Co-Structuring Advisors Morgan Stanley and TD Securities, BMO Capital Markets, MUFG and Société Generale acted as Joint Book-runners while Citizens Capital Markets, ING, Scotiabank, Standard Chartered Bank and Truist Securities acted as Passive Book-runners.

BofA Securities, BNP Paribas, CIBC Capital Markets, Mizuho, Natwest, PNC Capital Markets LLC, and SMBC Nikko acted as Co-Managers. Switch was advised by Kirkland & Ellis and Latham & Watkins represented the underwriters.