The impact of trade costs can be weak or strong – depending on how much countries trade

Many countries try to bring down trade costs by striking free trade agreements, forming currency unions or joining the WTO. But when trade costs fall, how much does trade increase? This column finds that the impact depends on how intensively countries trade. Falling trade costs boost trade between countries with initially ‘thin’ trading relationships where the scope for growth is largest. But they have a much weaker impact for country pairs that are already trading heavily.

A key research topic in international trade is the link between trade costs and trade flows (Arvis et al. 2013). If trade costs go down, by how much does trade go up? Economists refer to this as the ‘trade cost elasticity’.

To evaluate the effect of trade costs, researchers typically rely on a standard gravity equation framework and insert trade cost proxies as regressors on the right-hand side. For example, they might use bilateral distance or dummy variables for regional trade agreements and currency union status. This yields single coefficients to assess the trade effects of trade costs. By construction, these effects are homogeneous across all country pairs in the sample.

Challenging the view of homogeneous trade cost effects

In new research (Chen and Novy 2021), we propose a novel approach that is built on the idea that trade costs may not affect all trade flows in the same way. Trade costs might have a strong influence on trade between some countries but not between others. We therefore challenge the view that trade costs have a homogeneous ‘one-size-fits-all’ effect on bilateral trade flows. We offer an easy-to-implement alternative to the traditional gravity equation that allows us to estimate heterogeneous trade cost effects.

As our theoretical framework, we introduce heterogeneous trade cost effects by taking guidance from a translog gravity equation that predicts variable trade cost elasticities (Novy 2013). In this framework, ‘thin’ bilateral trade relationships (characterised by small bilateral import shares) are more sensitive to trade cost changes compared to ‘thick’ trade relationships (characterised by large bilateral import shares). The intuition is that small import shares are high up on the demand curve where sales are very sensitive to trade cost changes. Large import shares are further down on the demand curve where sales are more buffered. As a result, smaller import shares have a larger trade cost elasticity.

The prediction is that a given change in trade costs generates heterogeneous effects on trade flows. We should expect larger trade effects for country pairs associated with smaller import shares. This implies a heterogeneous effect even within country pairs since bilateral import shares typically differ depending on the direction of trade. We bring this framework to the data with a comprehensive data set of bilateral import shares for 199 countries from 1949 to 2013 with around one million observations, covering the vast majority of global trade after WWII.

Currency unions increase trade but not for everyone

As a prominent example, we consider the trade effect of currency unions (Rose 2000, Chen and Novy 2018). Currency unions are arguably an important institutional arrangement to reduce trade costs. Since WWII a total of 123 countries have been involved in a currency union at some point. But does that mean all currency union members experience an equal increase in international trade?

When we estimate a standard gravity regression without heterogeneous effects (i.e., imposing a constant trade cost elasticity), a common currency is associated with 29% more trade on average. But our flexible gravity framework demonstrates that this average hides a significant amount of heterogeneity across country pairs.

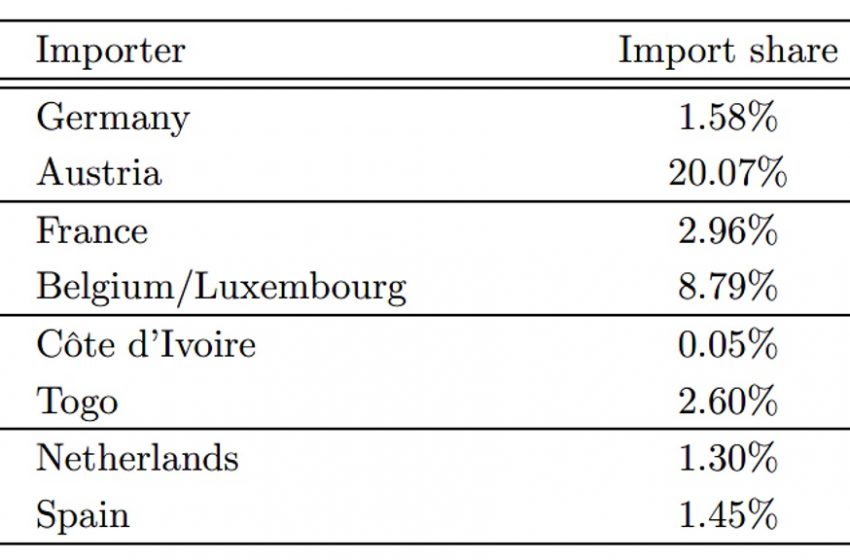

Table 1 The trade effects of currency unions

Notes: The currency union effects are obtained from PPML estimations. For each country pair the effects are evaluated at (log) predicted import shares for the year 2013. The final column indicates the increase in bilateral trade associated with currency union membership.

Table 1 shows a few examples. Bilateral trade effects tend to be particularly strong between countries where at least one partner is relatively small so that bilateral import shares can be small. For instance, we find a strong currency union effect (euro) for trade from Austria to Germany (62% more bilateral trade) as the Austrian share of total German imports is relatively small (1.58%). We also find a strong currency union effect (West African Monetary Union) for trade from Togo to Côte d’Ivoire (64% more bilateral trade with a corresponding bilateral import share of 0.05%).

Conversely, bilateral trade effects tend to be relatively weak or even zero between countries with large import shares, for example from France to Belgium-Luxembourg with an effect of 1% (given a fairly large import share of 8.79%). More generally, strong existing trade links and large import shares in the euro area help to explain why the trade effect of the euro has often been found to be quite weak (Baldwin 2006, Glick and Rose 2015).

Figure 1 The trade effects of the euro for German imports across bilateral partners

Notes: The black bars show bilateral import shares for euro area countries as a fraction of total German imports (see left axis). The red dots show the estimated currency union (euro) effects on bilateral trade (see right axis). Data for the year 2013 when the euro area had 17 member countries (Belgium and Luxembourg are counted as one for data purposes).

Figure 1 illustrates the heterogeneity with the example of the euro effect for German imports. The black bars represent the bilateral import shares of euro area countries into Germany for the year 2013 (encompassing all euro area members at the time). For instance, the Dutch share in German imports was just over 5%. The red dots show the corresponding estimated euro trade effects. It is modest for the largest trading partners (Netherlands, France and Belgium/Luxembourg), but it is very strong for small euro trading partners such as Estonia, Malta and Cyprus.

Bilateral asymmetries

One implication of our results is that the trade effect of currency unions can be heterogeneous within country pairs and therefore asymmetric by direction of trade. For example, Table 1 shows that the effect is large for trade from Austria to Germany (62%). But it is only 3% for trade in the opposite direction from Germany to Austria (given a very large bilateral import share of 20.07%).

Trade agreements are associated with more trade, but not every country pair gets the same boost

We also apply this framework of flexible trade cost effects to other trade cost-related variables popular in the international trade literature. In particular, we provide evidence of heterogeneous effects for regional trade agreements (RTAs) and WTO membership.

Table 2 shows the heterogeneous trade effects of RTAs and the WTO. Joining an RTA is associated with 64% more bilateral trade for an import share at the mean of the sample. But again, the estimates show a large degree of underlying heterogeneity. RTA membership is associated with 114% more bilateral trade for a country pair at the 10th percentile (i.e., a fairly small import share), but only 28% more trade at the 90th percentile (i.e., a fairly large import share). For WTO membership, the trade effect is 18% at the 10th percentile, and around zero at the 90th percentile. These findings are broadly consistent with the literature showing that the trade effects of trade agreements and WTO membership are heterogeneous (see Baier et al. 2019 and Fernandes et al. 2021 for RTAs, and Subramanian and Wei 2007 and Felbermayr et al. Yotov 2020 for WTO membership).

Table 2 The trade effects of trade agreements and WTO membership

Notes: Effects obtained from PPML estimations. The values indicate the increases in bilateral trade associated with trade agreements and WTO membership.

Implications for gravity estimation with PPML and OLS

To deal with heteroskedasticity and to include the zero import shares in the sample, we estimate our regressions by Poisson pseudo-maximum likelihood (PPML). In the context of currency unions, recent contributions show that estimating a gravity equation by PPML as opposed to log-linear ordinary least squares (OLS) reduces the size and significance of the estimated trade effect of currency unions, and in particular of the euro.

Our framework contributes to explaining this finding. As is well known, OLS and PPML estimators have different first-order conditions (Eaton et al. 2013). While the OLS conditions involve logarithmic deviations of trade from its expected value, the PPML conditions involve level deviations and therefore tend to give more weight to country pairs with high levels of trade. By highlighting that country pairs with higher trade intensity have a smaller trade cost elasticity, our framework therefore predicts that the PPML currency union estimate should be smaller than its OLS counterpart. This is indeed what we find in the data.

Policy implications

Policymakers should move away from the ‘one-size-fits-all’ perspective on trade cost effects. For example, if countries conclude a new trade agreement, trade is unlikely to increase by the same extent for all country pairs (not even within a given country pair depending on the direction of trade). Instead, we should expect trade to increase more strongly for thin trade relationships characterised by small import shares. Established relationships with large bilateral import shares may not expand trade much (in fact, may not expand at all). Policymakers therefore need to account for the distribution of trade shares to assess the impact of trade costs.

References

Arvis, J, Y Duval, B Shepherd and C Utoktham (2013), “Trade Costs in the Developing World: 1995-2010”, VoxEU.org, 17 March.

Baier, S L, Y V Yotov and T Zylkin (2019), “On the Widely Differing Effects of Free Trade Agreements: Lessons from Twenty Years of Trade Integration”, Journal of International Economics 116: 206-226.

Baldwin, R (2006), In or Out: Does it Matter? An Evidence-Based Analysis of the Euro’s Trade Effect, CEPR.

Chen, N and D Novy (2018), “Currency Unions Mean More Trade, But Not for Everyone”, VoxEU.org, 9 July.

Chen, N and D Novy (2021), “Gravity and Heterogeneous Trade Cost Elasticities“, Economic Journal (forthcoming); also available as CEPR Discussion Paper 16318.

Eaton, J, S Kortum and S Sotelo (2013), “International Trade: Linking Micro to Macro”, in D Acemoglu, M Arellano and E Dekel (eds), Advances in Economics and Econometrics Tenth World Congress, Volume 2: Applied Economics, Cambridge University Press.

Felbermayr, G, M Larch, E Yalcin and Y V Yotov (2020), “On the Heterogeneous Trade and Welfare Effects of GATT/WTO Membership”, CESifo Working Paper 8555.

Fernandes, A, N Rocha and M Ruta (2021) “The Economics of Deep Trade Agreements: A New eBook”, VoxEU.org, 23 June.

Glick, R and A Rose (2015), “The Currency Union Effect on Trade: Redux”, VoxEU.org, 15 June.

Novy, D (2013), “International Trade without CES: Estimating Translog Gravity”, Journal of International Economics 89(2): 271-282.

Rose, A K (2000), “One Money, One Market: Estimating the Effect of Common Currencies on Trade”, Economic Policy 30: 8-45.

Subramanian, A and S-J Wei (2007), “The WTO Promotes Trade, Strongly but Unevenly”, Journal of International Economics 72: 151-175.

This blog post is part of a series by the voxeu.org