globalbizmag.com

UAE Central Bank Keen to Launch its Digital Currency by Q3 of 2024

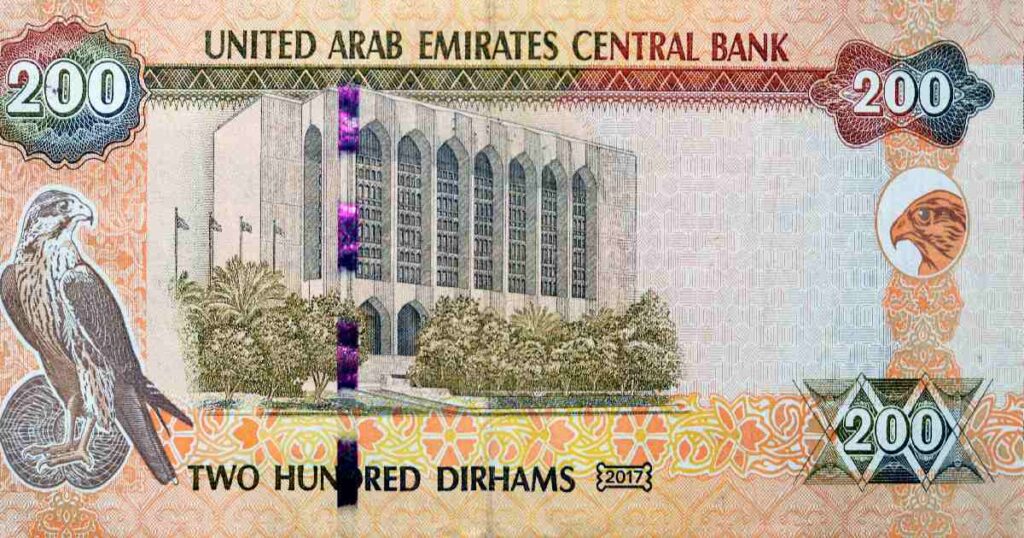

The UAE’s move to become a cashless society by 2030 received a boost with UAE Central Bank (CBUAE) planning to launch its digital currency as part of its 2023-26 strategy to become one of the top ten central banks worldwide.

The CBUAE has been encouraging digital currencies in the last few years with the support of cryptocurrencies and initiatives taken to develop the digital currency to reinforce its position as a leading global financial hub.

“Besides developing advanced and secure cloud infrastructure to operate financial and insurance services, the 2023-26 strategy aims to support the UAE’s green economy efforts and continue work to develop more innovative financial infrastructure to boost the country’s competitiveness in this field,” the UAE Central Bank said in a statement a few days ago.

As per the 2023-26 strategy, the CBUAE is also planning to promote digital transformation in the entire finance sector. To foster financial inclusion, it plans to take measures such as the use of digital IDs, AI, and ML to improve inspection and monitoring.

The strategy is also one of nine initiatives in the CBUAE’s Financial Infrastructure Transformation (FIT) Programme and sets out a roadmap for applying CBDC across a range of domestic and cross-border use-cases in the region.

Project Aber

The CBUAE has started work to have its digital currency in 2019 and has launched a pilot project – Project Aber – by collaborating with Saudi Arabia for a cross-border payment project using blockchain technology. The project concluded that distributed ledger technology can be used to facilitate cross border transactions successfully.

Encouraged by the response, the UAE also launched its first real-value cross-border CBDC pilot under the ‘mBridge’ project with the Hong Kong Monetary Authority, the Bank of Thailand, the Digital Currency Institute of the People’s Bank of China, and the Bank for International Settlements in 2022. This Multiple Central Bank Digital Currency (m-CBDC) bridge is expected to test the use of distributed ledger technology for foreign currency payments.

Subsequently, the CBUAE has launched its CBDC Implementation Strategy in collaboration with R3, G42 Cloud and Clifford Chance in April this year. For Phase 1, R3 and G42 Cloud have been selected as the technology and infrastructure providers while Clifford Chance will provide critical legal oversight for the strategy.

While R3 is a leader in digitization of financial services, the UAE-based G42, also known as Group 42, is a technology group that invents visionary artificial intelligence and Clifford Chance is a reputed law from based in the UK.

The first phase of the CBDC strategy, expected to begin within the next 12-15 months, will include a soft launch of mBridge, proof-of-concept work for bilateral CBDC bridges with India, and proof-of-concept work for domestic CBDC issuance covering wholesale and retail usage.

CBDCs Becoming Popular

According to The Atlantic Council, 11 countries have adopted central bank digital currencies (CBDC), with an additional 53 being in advanced planning stages and 46 researching the topic as of June this year.

The Council’s data showed that the earliest digital version of a fiat currency issued by a central bank was the Bahamian Sand Dollar introduced in 2019. The most recent addition to the countries issuing a CDBC is Jamaica with JAM-DEX, which was added to mobile payment provider Lynk in July 2022.

In June 2021, only six countries had adopted this type of digital currency, all of which were Caribbean islands. Nigeria introduced the eNaira in October 2021, with four additional Caribbean-island states following until July 2022.

Even the European countries are coming out with digital euro, and the European Union (EU) is currently setting up a legal framework for digital currency and a final decision will be taken by the European Central Bank in October 2023.