globalbizmag.com

African Start-ups Raise $3.5 Billion in Funding in 2023

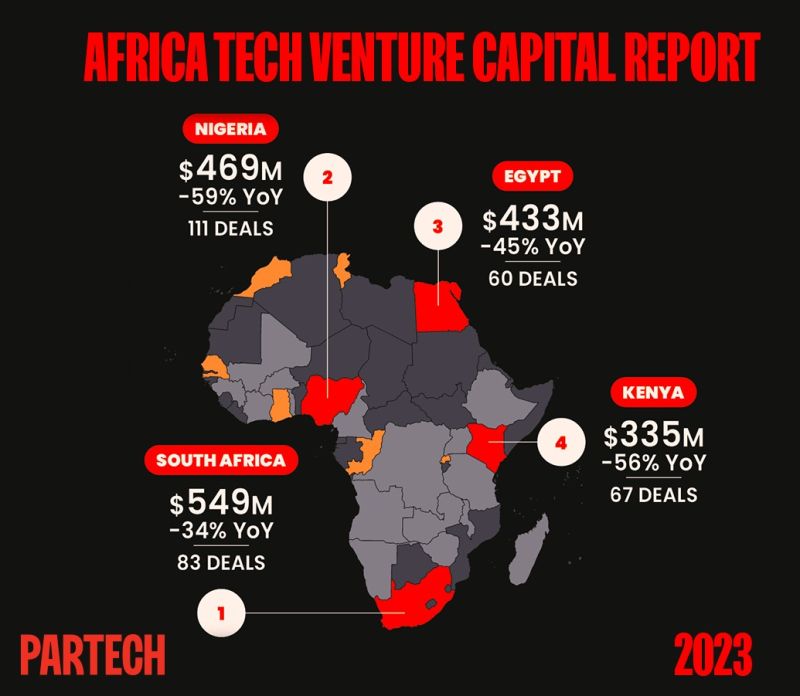

Partech Africa, the VC fund dedicated to technology start-ups in Africa, said that African technology start-ups have secured $3.5 billion in total funding (equity and debt combined), marking a 46% decrease from the previous year, spread across 547 deals (-28% YoY) in 2023.

South Africa topped the list in value with a total investment of $549 million across 83 deals, followed by Nigeria with $469 million through 111 deals, and Kenya in fourth place with a total investment of $335 million across 67 deals, Partech Africa said.

In its latest annual report entitled “Africa Tech Venture Capital,” Partech Africa, however, said that despite a 22% drop in the debt funding raised from $1.6 billion in 2022 to $1.2 billion in 2023, the sector showed resilience with a modest increase in the number of debt deals from 71 in 2022 to 74 in 2023.

The report, which aims to provide a comprehensive and in-depth view into the evolution of the Africa Tech VC ecosystem, revealed that, in line with the global downturn in venture capital funding, the African tech sector also saw a significant slowdown in 2023, securing only half the amount of funding it did in 2022.

Technological deals in Egypt, which was ranked fourth, witnessed a significant decline, with their number dropping by 58% to 60 deals, and their value decreasing by about 45% annually to reach $432 million.

“However, this figure did not accurately reflect the actual decline, as one deal accounted for about 60% of the total, which was the financing raised by EMNT with a value of $260 million through the sale of shares, in addition to issuing $140 million in bond notes,” the report said.

The financial technology sector accounted for 70% of venture capital funding in Egypt last year, taking into account the impact of the EMNT deal on the figures. Meanwhile, the healthcare technology sector accounted for about 10% of total funding, followed by the e-commerce and software sectors.

The report said that venture capital funding declined amid the pressures it faced, as well as the individual economic challenges of the top four countries mentioned above faced. These challenges include currency devaluation in Egypt and Nigeria, which contributed to undermining the investment climate, leading to the closure of start-ups and a decline in investors.

Picture Source: Partech

Better than Latam and Southeast Asia region

Cyril Collon, General Partner at Partech, said that two years into the global downturn, it’s clear the African tech ecosystem has been experiencing the full severity of it even though it fared much better than the Latin America and Southeast Asia regions.

“Despite this correction, over the last 10 years, the African tech ecosystem has still grown nearly 10x in transactions and funding amount with about $20 billion invested in roughly 3,000 deals, 68% of it in the last three years,” Collon added.

The report also noted that the equity funding experienced a general downward trend impacting all aspects of investment. Outside of the top four countries, Morocco and Ghana were the only other countries surpassing the $50 million equity funding threshold, the report said.