A farmer shows rice grains after harvesting them from a field in the province of Al-Sharkia, northeast of Cairo, Egypt, September 21, 2021. REUTERS/Mohamed Abd El Ghany

Analysis: Strong Asian rice demand for animal feed sparks food supply worries

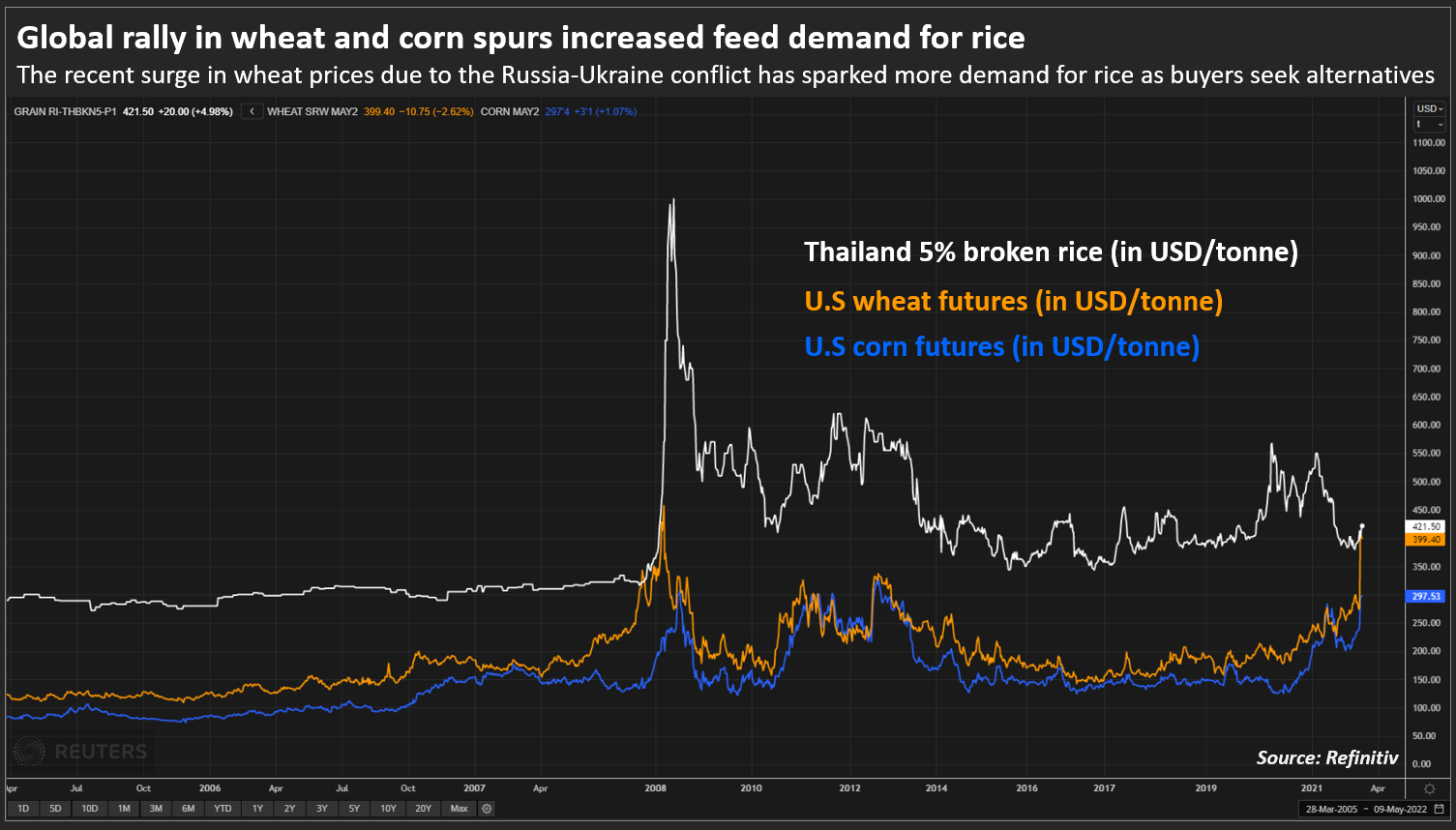

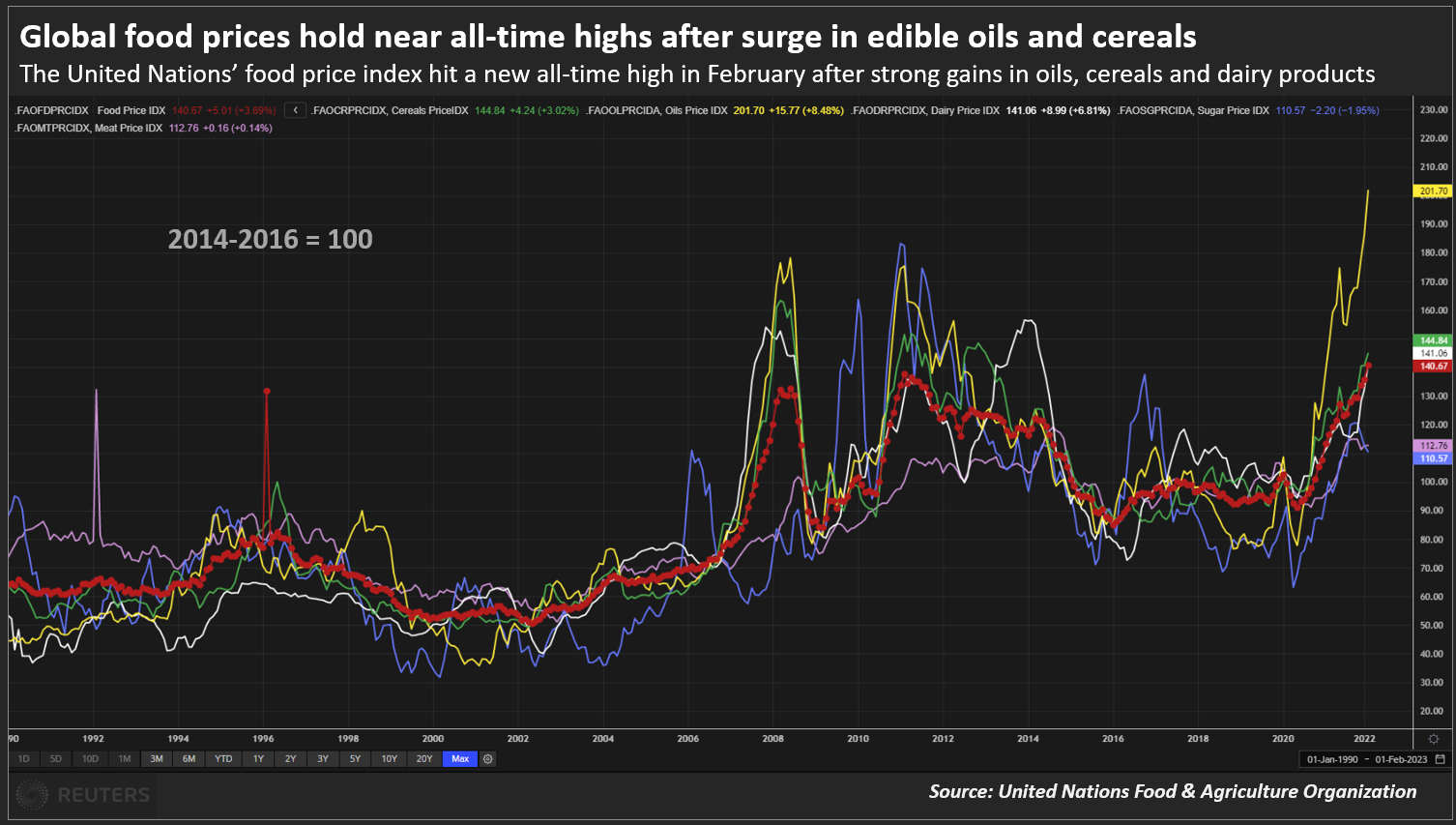

A surge in wheat and corn prices is boosting demand for low-grade rice in animal rations across Asia, pushing up prices of the world’s most important staple at a time when global food inflation is already hovering near record highs.

Global crop importers are scrambling for supplies after Russia’s invasion of Ukraine severed grain shipments from the two countries, which together account for around 25% of world wheat and 16% of world corn exports. read more

Chicago wheat futures hit a record high last week while corn climbed to its highest in a decade after war-torn Ukraine shut its ports and Western sanctions hit Russian exports.

The price spikes in wheat and corn in turn pushed buyers to seek alternatives, including in China, by far the world’s largest feed market. Importers there are in talks to buy extra volumes of broken rice – inferior rice where the grains have been fractured during the milling process – to fatten hogs and other animals, traders and analysts said.

Rice typically trades at a steep premium to wheat, but wheat’s blistering 50% price surge from a month ago has sharply cut the difference between the two grains, and even made wheat more expensive than some lower grades of rice.

Benchmark food-grade rice from Thai exporters made its biggest weekly gain since October 2020 last week on the back of firmer food and feed demand, climbing 5% to around $421.50 a tonne.

That’s the highest since last June, and sources say prices may keep rising if the disruption to Black Sea flows persists. Export prices from Vietnam and India have also climbed.

“There could be greater interest in broken rice for animal feed if the strength currently dominating wheat and corn markets persists,” said Rome-based FAO rice economist Shirley Mustafa.

“It is not just animal feed, there could also be a substitution in other use sectors, such as more people turning to rice for their meals.”

CORN CUT

China had booked up to two million tonnes of Ukrainian corn imports for this year, but most of those shipments are now in jeopardy given the disruption to Ukraine’s logistics chains.

To replace those lost volumes, China is expected to import around three million tonnes of broken rice, up from about two million tonnes annually in the past two years, said a Beijing-based rice trader.

One importer in Guangdong is looking to buy broken rice from Thailand, while others have recently bought Indian broken rice for feed, according to another source briefed on the matter.

“Demand for Indian broken rice has gone up because of higher corn prices. Feed makers are trying to replace corn with rice,” B.V. Krishna Rao, president of India’s Rice Exporters Association, told Reuters.

Prices of 100% Indian broken rice have moved up to $320 per tonne this month from $290 in February, he added.

Further underpinning rice prices, feed makers in Thailand are also looking at using more broken rice to replace corn, pushing up domestic prices across the country, said Bangkok-based traders.

“There is tremendous increase in demand for lower quality rice from Thailand’s animal feed industry,” said one trader in Bangkok. “In fact, much of Thailand’s broken rice is likely to be consumed in the domestic market.”

FOOD FEARS

Global rice prices could rise further in the second quarter if wheat consumers in India – the second largest rice user after China – switch to rice due to record high domestic wheat prices , which would accelerate any decline in rice inventories, said Chookiat Ophaswongse, honorary president of Thai Rice Exporters Association.

While global rice inventories are set to hit a record 190 million tonnes this year, according to the U.S. Department of Agriculture, global rice output is expected to exceed world consumption by less than 5 million tonnes in 2022, so a sudden climb in worldwide demand could quickly start to deplete those inventories and reinforce bullish sentiment in the market.

In turn, an increase in rice prices will intensify food security worries for some of the poorest nations in Africa and Asia, where millions rely on cheap availability of the staple.

“As of now, broken rice is mainly for the feed sector, but as the war gets prolonged and buyers are not able to get hold of adequate wheat, then it comes to food security,” said one Singapore-based grains trader.

“Buyers will do whatever they can to replace expensive wheat with rice or other alternatives.”

Reporting by Naveen Thukral; aditional reporting by Hallie Gu in Beijing, Khanh Vu in Hanoi, Patpicha Tanakasempipat in Bangkok and Rajendra Jadhav in Mumbai; editing by Gavin Maguire and Richard Pullin

This article was originally published by Reuters.