globalbizmag.com

Aramcos’ Net Income Down in Q1-2023

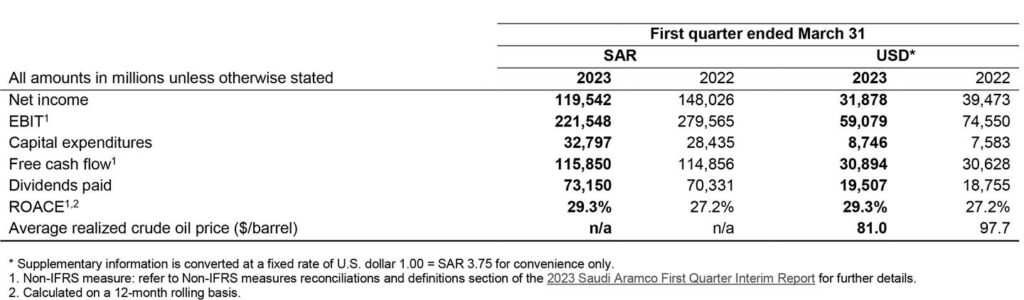

Saudi Arabia’s energy major Aramco, the world’s second biggest company after Apple Inc, on Tuesday reported a first quarter 2023 net income of $31.9 billion, as against $39.5 billion for the same period in 2022.

Q1 net income remains robust and the energy giant’s growth strategy is on track as downstream expansion progresses. The company’s cash flow from operating activities was $39.6 billion while it was $38.2 billion in Q1-2022.

Aramco paid Q4-2022 dividend of $19.5 billion in the first quarter, representing a 4% increase on the previous quarter. The Q1-2023 dividend of $19.5 billion will be paid in the second quarter of this year. The company has announced its intention to introduce a mechanism for performance-linked dividends, in addition to the base dividend.

In his comments, Aramco President & CEO Amin H Nasser, said that the results reflected Aramco’s continued high reliability, focus on cost and our ability to react to market conditions, as it generated strong cash flows and further strengthen the balance sheet.

More Commitments

The results also reinforced Aramco’s commitment to maximize long-term shareholder value and the company intends to introduce a mechanism for performance-linked dividends, in addition to the base dividend the Company currently distributes. Nasser announced.

“Our growth strategy remains on track, and we made significant progress on the strategic expansion of our downstream business during the quarter, announcing a key acquisition in the US as well as important investments and partnerships in China and South Korea. Our global downstream strategy is gaining momentum, and we are leveraging cutting-edge technologies to increase our liquids-to-chemicals capacity and meet anticipated demand for petrochemical products,” he said.

According to him, the company is moving forward with its capacity expansion, and its long-term outlook remained unchanged as the company believes oil and gas will remain critical components of the global energy mix for the foreseeable future.

“Our intention is to continue to be a reliable energy supplier with the ability to provide more sustainable energy solutions, supporting efforts to achieve an orderly energy transition. By working to further reduce the carbon footprint of our operations and adding new lower-carbon energy options to our portfolio, I am confident about the contributions we will make,” he added.

The company’s extraordinary general assembly has approved bonus shares grant of one share for every 10 shares held.

Aramco also announced plans for major investments to advance strategic downstream expansion in key global markets. It said the recent agreement with Linde Engineering for the development of a new ammonia cracking technology supports the advancement of lower-carbon energy solutions.

Key Highlights

Net income: $31.9 billion (Q1-2022: $39.5 billion)

Cash flow from operating activities: $39.6 billion (Q1-2022: $38.2 billion)

Free cash flow1: $30.9 billion (Q1-2022: $30.6 billion)

Gearing ratio: -10.3% as on 31 March 2023, compared to -7.9% at end of 2022

Q4-2022 dividend of $19.5 billion paid in the first quarter, representing a 4.0% increase from the previous quarter

Q1 2023 dividend of $19.5 billion to be paid in the second quarter

Intention to introduce a mechanism for performance-linked dividends in addition to the base dividend

Major investments advance strategic downstream expansion in key global markets

iktva signings worth around $7.2 billion expected to further strengthen supply chain efficiency

Agreement with Linde Engineering for the development of a new ammonia cracking technology, which supports the advancement of lower-carbon energy solutions.