Representation of cryptocurrency bitcoin is seen in this illustration taken November 29, 2021. REUTERS/Dado Ruvic/Illustration

Blue Monday? Bitcoin tumbles 5% after weekend battering

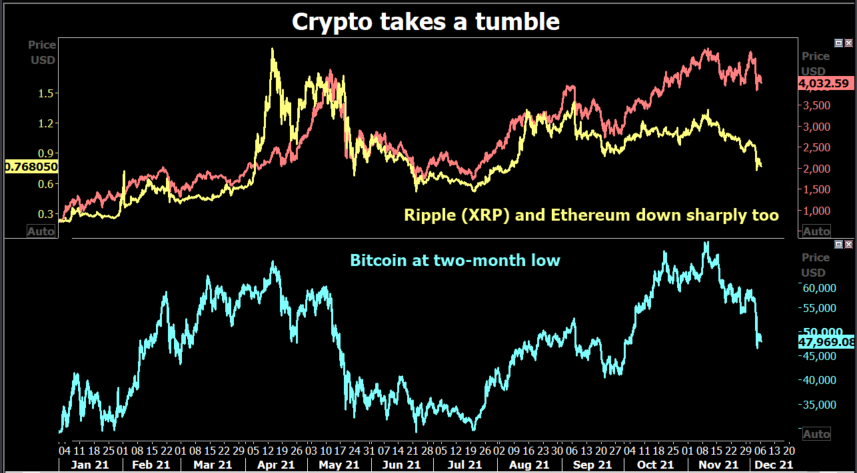

HONG KONG, Dec 6 – Bitcoin tumbled almost 5% on Monday as the start of the week offered little respite to the world’s largest cryptocurrency after a bruising weekend where at one point it lost over a fifth of its value.

The rout sent bitcoin’s price and the amount invested in bitcoin futures back to where they were in early October, before a massive price surge that sent the token to an all-time high of $69,000 on Nov. 10.

It was last down 3.9% at $47,567.

Traders said the weekend fall was connected to a broad move away from riskier assets in traditional markets over worries about the Omicron variant of the coronavirus, combined with lower trading liquidity that tends to plague cryptocurrencies at weekends.

“Our expectation is the rest of Q4 will be a hard month; we aren’t seeing the strength in bitcoin that we generally see after one of these crushing days,” said Matt Dibb at Stackfunds, a Singapore-based crypto fund distributor

“Leverage markets have been completely reset, and open interest within leverage markets has completely reset.”

Crypto data platform Coinglass showed open interest – the total number of futures contracts held by market participants at the end of the trading day – across all exchanges was last at $16.5 billion compared with $23.5 billion on Thursday, and as much as $27 billion on Nov 10.

“There’s barely any liquidity on weekends so markets are slightly more vulnerable to shocks – that and a lot of demand coming from institutionals, and they’re not trading over the weekend,” said Joseph Edwards, head of research at crypto brokerage Enigma Securities in London.

Over the weekend, as prices fell, investors who had bought bitcoin on margin saw exchanges close their positions, causing a cascade of selling. A range of retail-focused exchanges closed more than $2 billion of long bitcoin positions on Saturday, according to Coinglass.

Some exchanges allow traders to place bets 20 times or more the size of their investment, meaning a small move in the wrong direction can cause exchanges to liquidate clients’ positions when their initial investment is gone.

Ben Caselin at Asia-based crypto exchange AAX said liquidity had become thin because of bitcoin moved off exchanges to offline digital wallets.

Ether , the world’s second-largest cryptocurrency, was also hit on Saturday, albeit less hard. It tumbled 5.5% on Monday however to $3,965, versus its Nov. 10 high of $4,868, though has gained on its larger rival.

On Sunday, one ether rose to as high as 0.086 bitcoin , its highest since May 2018.

On Monday CME Group Inc (CME.O) will launch ether mini futures, which they hope will let traders better manage the risk of trading the coin.Reporting by Alun John in Hong Kong and Tom Wilson in London. Editing by Gerry Doyle and Carmel Crimmins

Our Standards: The Thomson Reuters Trust Principles.

This article was originally published by Reuters.