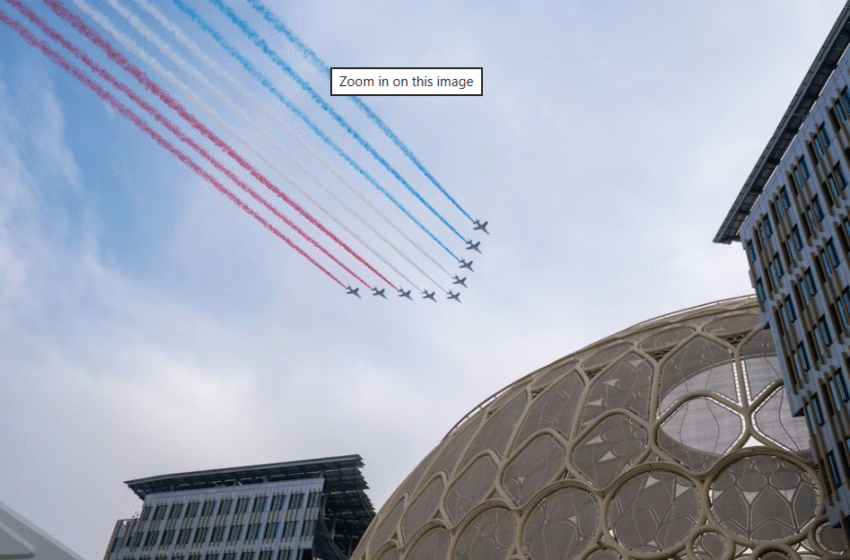

Dubai Airshow 2025 Sees Emirates & flydubai Double Down on Long-Haul Ambitions

The Dubai Airshow 2025 has delivered yet again on spectacle and strategic signaling — but this time, it’s not just about new aircraft orders. Emirates and flydubai, two of the UAE’s aviation flagship carriers, have placed a combined order that could reshape their long-haul capacity and send ripples through the global aerospace industry: 190 engines from GE Aerospace.

This is more than a routine refresh. It’s a bet — a major, long-term bet — on growth, efficiency, and global connectivity. And while the headlines will spotlight the dollar values and delivery timelines, the real story lies in what this means for Emirates’ expansion, flydubai’s transformation, and the broader economic implications for both the UAE and its aerospace partners.

What’s Being Ordered — And Why It Matters

At the heart of the announcement lies Emirates’ order for 65 additional Boeing 777-9 aircraft, which will be powered by 130 GE 9X engines. This deal, valued at US$ 38 billion at list price, is a monumental reinforcement of Emirates’ long-term commitment to Boeing’s 777X program. With this addition, Emirates’ wide-body orderbook swells to 315 aircraft, including 270 777X jets, 10 freighters, and 35 Boeing 787s.

On the engine front, Emirates’ total order for the GE9X engine now stands at 540 units, making it one of the largest GE9X customers globally. GE Aerospace, for its part, has renewed confidence in this partnership: “We are proud to deepen our decades-long partnership with Emirates … this additional GE9X order reflects Emirates’ confidence in our technology and our team,” said Russell Stokes, President & CEO of GE’s Commercial Engines & Services.

Meanwhile, flydubai, making a very deliberate pivot into the long-haul game, announced its own GE engine order: 60 GEnx-1B engines to support its fleet of Boeing 787-9 Dreamliners. This is a defining moment for the budget carrier, signaling that it’s no longer content with regional or medium-haul markets — it is ready to play on the global long-haul stage.

Strategy, Scale, and the Stakes for the UAE

1. Emirates’ Long-Haul Gamble

Emirates’ fleet strategy has always revolved around large, efficient wide-body aircraft. Its renewed commitment to the 777X — despite repeated delays in certification — signals long-term confidence. The flexibility in the agreement, which allows part of the order to be converted into the proposed 777-10 or 777-8, suggests Emirates is planning for scenario-based expansion.

By locking in 540 GE9X engines, Emirates also ensures a stable pipeline for spare parts, maintenance, and engine services. This is not just about growth — it’s about ensuring operational resilience and driving economies of scale. Given the 777X’s potential fuel efficiency gains and capacity, this could significantly reduce Emirates’ long-haul cost per seat over time.

2. flydubai’s Ambitious Pivot

Flydubai has historically operated only narrow-body aircraft, but its order for GEnx engines marks a clear strategic inflection: the airline wants to be a global player, not just a regional low-cost carrier. The 787-9 allows it to open new markets, connect under-served long-haul routes, and better diversify its business model. This could help Dubai (and by extension, the UAE) strengthen its position as a major global connector hub.

3. Economic and Geopolitical Implications

The Emirates-GE order has a strong industrial dimension. As Emirates’ own statements note, the deal supports “hundreds of thousands of high-value manufacturing jobs” across the U.S. This is not just commercial aviation — it’s part of a broader manufacturing and trade ecosystem. GE Aerospace’s renewed engine demand helps sustain its production lines, supply chains, and R&D investments. In that sense, the UAE’s orders reinforce not only its aviation ambitions but also economic ties with the U.S. aerospace sector.

Risks, Questions, and What Could Go Wrong

Regulatory and Certification Risk: The 777X has seen repeated delays in certification. Emirates’ decision to place more orders underlines faith in Boeing’s roadmap, but delivery risk remains non-trivial.

Fuel Price Volatility: Long-haul economics are deeply sensitive to fuel costs. While modern engines like the GE9X and GEnx promise better fuel efficiency, any spike in oil prices could erode the cost advantages or make projected profitability more challenging.

Competition & Capacity Risk: As both carriers expand, they risk saturating long-haul routes or cannibalizing each other. Flydubai’s long-haul push could overlap with Emirates’ network unless carefully managed.

Sustainability Pressure: In an era where carbon emissions and sustainability are strategic priorities, large wide-bodies (even efficient ones) face pressure. Both Emirates and flydubai will likely need to demonstrate strong sustainability credentials — and that could mean accelerated adoption of Sustainable Aviation Fuel (SAF) or investment in newer engine technology.

Why This Is a Big Deal, Beyond the Numbers

Put simply: this isn’t just a procurement story. It’s a strategic bet on long-term growth, on Dubai as a global aviation hub, and on reinforcing industrial ties with U.S. aerospace.

- For Emirates, the order strengthens its backbone: its long-haul fleet. It’s not just refreshing its fleet — it’s future-proofing it, giving itself optionality with 777-10 or 777-8, and locking in engine supply.

- For flydubai, it’s a bold shift; a low-cost airline transforming itself into a hybrid global carrier, not afraid to compete on long-distance routes.

- For the UAE economy, this is a lever for its global connectivity ambitions. As Dubai positions itself as a world-class aviation and trade hub, its national carriers are putting their money where their mandate is.

Importantly, from the GE Aerospace and U.S. manufacturing side, this order is a vote of confidence in GE’s engine technology and in the U.S. as a manufacturing base. It supports thousands of high-value jobs, boosting aerospace production capacity, and highlighting the mutually beneficial trading relationship between the U.S. and UAE.

Economist’s View: Why This Makes Economic Sense

While few published economists have commented directly on this specific engine order, the broader economic logic aligns with expert views on how aviation capital expenditure can drive growth, connectivity, and industrial development.

One relevant perspective comes from analyses of long-term investment in aerospace: large aircraft orders like Emirates’ help anchor multi-billion-dollar manufacturing ecosystems, not just in aircraft assembly but in engines, MRO, and high-skilled labor. For instance, Emirates’ own economic-impact studies (referenced in their investor communications) suggest that its aircraft and engine purchases support millions of job-years in aerospace manufacturing and services.

Moreover, analysts like those at SimpleFlying argue that Emirates’ choice of the 777X is strategic fleet modernization. The 777X — when operational — offers a powerful combination of large capacity, long range, and fuel efficiency. From an economist’s lens, that’s precisely the kind of investment that can deliver economies of scale, lower unit costs, and improved long-haul profitability.

There’s also a macro-trade dimension: such orders deepen industrial linkages between global economies, reinforcing trade and employment in high-value sectors. Emirates’ order not only underlines its hub ambitions but also helps sustain global aerospace supply chains — a cross-border economic multiplier.

A Bold Move — But One That Needs to Deliver

The 190-engine order at Dubai Airshow 2025 is a statement. It’s a declaration that Emirates and flydubai mean business in the long haul, that they’re investing in capacity and capability, and that they’re confident in GE’s engine technology. But like all bold bets, it comes with risk: certification delays, market dynamics, cost volatility, and sustainability pressures could all test how well this strategy plays out.

If successful, though, it could reshape not just the UAE’s aviation network but also contribute to global aerospace growth. For GE Aerospace, for Boeing, and for Dubai, it’s more than a deal — it’s an anchor of long-term partnership and shared ambition.