Containers are loaded onto a ship at the port of Rotterdam, Hook of Holland, Netherlands, September 11, 2018. REUTERS/Piroschka van de Wouw

Morning Bid: Trade-offs

A look at the day ahead in markets from Sujata Rao

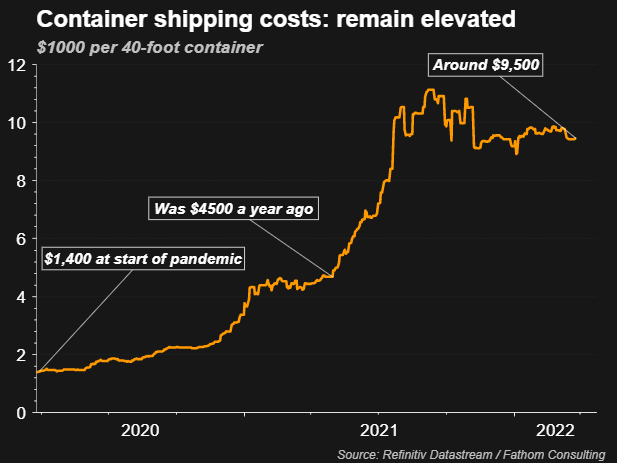

It’s not just the costs of producing goods that’s going up, the price that must be paid to transport them shows no sign of easing — shipping a 40-foot container unit by sea costs double what it did a year ago and remains six times above pre-pandemic levels, the Freightos FBX index shows.

This will add 1.5 percentage points to 2022 inflation, according to the International Monetary Fund (IMF), which warns that consumers will feel the full brunt of price increases only after 12 months.

This causes “complicated trade-offs” for central bankers, the IMF says.

Or maybe not. Money markets are betting policymakers will opt to stomp inflation, even at the expense of economic growth. More than 200 basis points of U.S. rate rises are priced by end-2022, which if realised, would be the most in a calendar year since 1994, Deutsche Bank points out.

In any case, the gap between two- and 10-year Treasury yields seems well on the way to turning negative for the first time since 2019, narrowing below 6 bps on Tuesday.

This is the so-called curve inversion that is considered a reliable predictor of recession. Yet, the Fed has signalled it’s watching other curve segments which are still steep, giving it room to tighten policy further and faster.

The question is when do stock markets start to get seriously spooked? While two-year U.S. yields rose 165 bps this quarter and the 2-10 curve has snapped in some 70 bps, world stocks have recouped some gains recently and will end the quarter with only a small loss.

On Tuesday, Wall Street equity futures are positive and European stocks are higher, following on from Asian gains led by a 1% rise in Tokyo (.N225) read more .

They likely have their eyes trained on “real” interest rates; stripping out inflation, 10-year yields remain deeply negative while “real” yield curves are so far sloping upwards.

Key developments that should provide more direction to markets on Tuesday:

-BOJ ramps up battle to defend yield cap read more

-German consumer sentiment lowest since Feb 2021 read more

-ECB President Christine Lagarde, ECB bank supervisor Elizabeth McCaul, ECB board member Peter Kazimir

-New York Fed president John Williams, Philadelphia Fed president Harker

-U.S. monthly house price index, JOLTS job openings, consumer confidence

-U.S. 7-year note auction

-Chile to raise interest rates by 200 bps to 7.5%

Reporting by Sujata Rao; editing by Karin Strohecker

This article was originally published by Reuters.