globalbizmag.com

UAE Ranked Second Globally in Attracting Greenfield FDI Projects in 2023

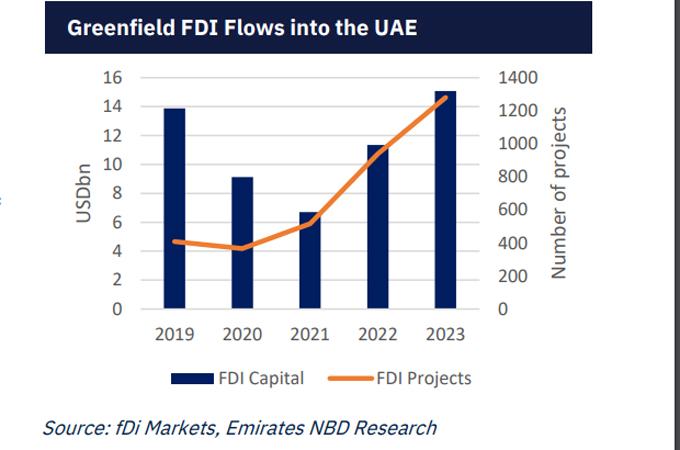

The UAE ranked second globally in the number of greenfield FDI projects in 2023, with 1280 projects, trailing only behind the US, which led with 1966 projects, Emirates NBD said in a report on Wednesday.

The number of greenfield FDI projects in the UAE surged by 36% y-o-y, taking the UAE up three places in the global ranking from fifth in 2022. The remarkable growth in greenfield FDI in the UAE for 2023 can be attributed to a confluence of strategic regulatory reforms and ambitious trade agreements.

The introduction of regulatory reforms, including the allowance of 100% foreign ownership in specific sectors, enhanced intellectual property protections, and streamlined licensing procedures, has significantly bolstered the UAE’s appeal to international investors.

“These changes have not only facilitated ease of doing business but have also instilled confidence among foreign investors regarding the protection of their investments,” the report said.

While Dubai retained its position as the leading city in the number of greenfield FDI projects, surpassing Singapore and London, with 1036 projects, marking a 32% increase y-o-y, Abu Dhabi ranked 6th globally with 172 projects, showing a substantial 74% increase y-o-y. Notably, Dubai accounted for approximately 81% of the total number of projects in the UAE, the report, citing data from the Financial Times fDi Markets database.

Total FDI capital inflows into the UAE increased by 33% y-o-y to $15.08 billion. Among the seven Emirates, Dubai attracted the largest share of FDI capital inflows, totalling $6.81 billion. Despite only having 13% of the total number of projects in UAE, Abu Dhabi accounted for a significant share of the total FDI capital inflows with $4.48 billion.

Abu Dhabi had the biggest number of projects that exceeded the $200 million mark with eight projects while Dubai had five. Sharjah followed in third place with $2.75 billion, with the bulk of the inflows coming from the India-based Infinite Mining & Energy investment in a new petroleum refinery in Hamriya Free Zone.

The estimated number of jobs created from greenfield FDI projects in the UAE increased by around 16% to 47,184 jobs last year. Greenfield FDI Flows into the UAE

Dubai leads in greenfield HQ Projects

Dubai also maintained its status as the leading hub for new greenfield headquarters projects with 60 projects in 2023, surpassing Singapore and London, which had 40 and 31 respectively. Riyadh was in fourth place with 22 new greenfield HQ projects last year.

The UAE ranked third globally with 76 greenfield headquarters projects, trailing behind the UK and the US, which had 86 and 164 respectively. Notable among these projects was the opening of a regional headquarters for the US-based Odys-Aviation, a company specialising in hybrid electric vertical take-off and landing (VTOL) aircraft for regional distances. The investment was facilitated by the Ministry of Economy’s NextGen FDI program.

Among all sectors, the business services sector had the largest number of greenfield FDI projects in 2023 with 383 projects. Most of the projects were in the advertising and PR related sub-sector (66 projects) followed by employment services (59 projects), and professional, scientific, and technical services (38 projects).

The software and IT services sector came in second with 269 projects, followed by the financial services sector in third place with 131 projects.

Fossil Fuels Attract Largest Value of FDI

The coal, oil and gas sector attracted the most greenfield FDI capital flows at $2.6 billion, largely due to the investment from the Indian company Infinite Mining & Energy, which invested $2.5 billion to open a new petroleum refinery in the Hamriya Free Zone in Sharjah that will operate at a capacity of 10,000 barrels per day. The project is the first significant investment into the coal, oil and gas sector since 2020.

The renewable energy sector followed in third place with $1.57 billion in FDI inflows and the biggest renewable project last year was a joint venture between Masdar and France based Electricite de France to build Abu Dhabi’s largest solar rooftop at Warner Bros World in Yas Island for an estimated $633 million. The project features the installation of 920 solar modules and is designed to offset 450 tonnes of CO2 emissions per year.

The synergy between improved investment conditions and robust trade partnerships has not only accelerated economic growth but also promises to sustain the momentum of FDI inflows into the future and achieve the goal of $150 billion in FDI Inflows by 2031.