IMAGE COURTESY: Redfin

US Real Estate Market Worth $47.5 Trillion

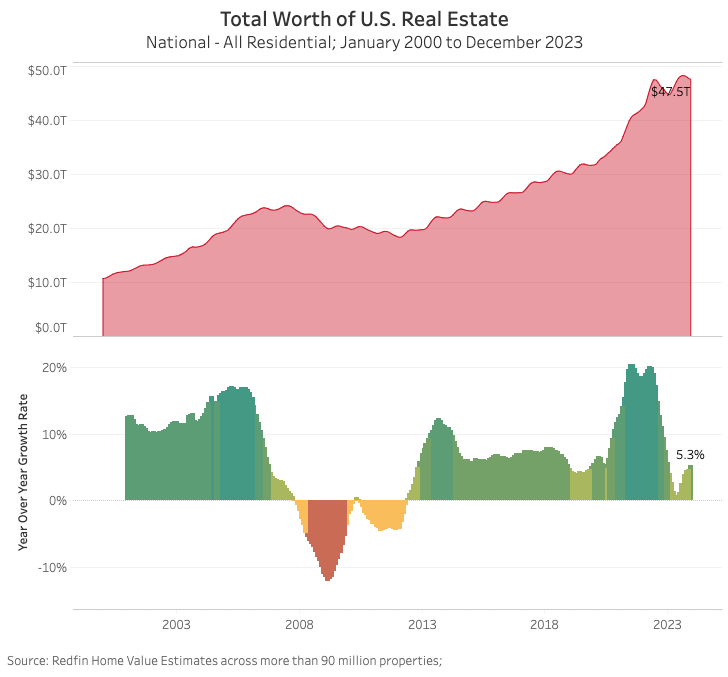

The residential real estate market in the US, which has gained $2.4 trillion over the last year, stands as one of the largest asset classes in the country and valued at a whopping $47.5 trillion in 2023, according to a report by US-based Redfin.

Redfin Corporation is based in Seattle and provides residential real estate brokerage and mortgage origination services. The company operates in more than 100 markets in the US and Canada.

The report authored by Redfin Economics Research Lead Chen Zhao and Data Journalist Lily Katz, said that despite a slowdown in home sales, the total value of homes increased $2.4 trillion last year as low inventory levels pushed up prices. Affordable metropolitan areas saw steady price growth, while expensive metros experienced slower price appreciation.

To calculate the largest US housing markets, The Redfin Estimate, which calculates the market value of an individual home, has analysed 90 million properties covering single-family homes, townhouses, condos, and 2-4 unit multifamily properties across the country.

In terms of percentage, the total value of US homes increased 5.3% from a year earlier in December 2023, the biggest increase in 11 months, and was up 13.3% ($5.6 trillion) from two years earlier.

New York Tops The List at $2.4 Trillion

“Prospective buyers aren’t as lucky. The combination of elevated mortgage rates, high home prices and a limited pool of homes for sale means homeownership is about as unaffordable as ever. One bright spot for buyers is that mortgage rates should start declining before the end of 2024.”

Listed below are the most valuable residential markets as of December 2023:

| Rank | U.S. Metro | Total Value of Homes | Total Value of Homes YoY Change |

| 1 | New York | $2.4T | -1.0% |

| 2 | Los Angeles | $2.1T | +4.3% |

| 3 | Atlanta | $1.2T | +6.2% |

| 4 | Boston | $1.2T | +8.3% |

| 5 | Anaheim | $1.1T | +8.0% |

| 6 | Washington DC | $1.0T | +6.2% |

| 7 | Chicago | $991B | +7.4% |

| 8 | San Diego | $988B | +9.4% |

| 9 | Phoenix | $987B | +4.2% |

| 10 | Seattle | $911B | +4.6% |

Top 10 Cities

With a housing market worth $2.4 trillion, New York tops the list. Unlike the majority of large US cities, the aggregate value of homes declined as buyers became increasingly priced out of the market.

At the same time, homeowners hesitated to sell in order to lock in low mortgage rates. In fact, more than 80% of mortgage holders in New York City have interest rates that are 5% or lower.

Los Angeles is ranked second, with a residential real estate market worth $2.0 trillion. Last year, existing home sales tumbled 24.8%, falling to the lowest point since 2007. However, the housing shortage led prices to increase amid high demand. The median sale price climbed to $975,000 in February 2024, a 5.9% jump compared to the same time last year.

Atlanta is in the third place and is the most overpriced housing market in the US, according to the analysis. Homes have been selling for 41.7% more than their worth as of February 2024 data.

The major reason driving people to flock to Atlanta is the general housing affordability along with its thriving tech center. Along with this, state tax credits have increasingly made it a hub for the TV and film industries, earning it the moniker “Y’allywood.”

Another factor in Atlanta’s inflating housing market are large investment firms, which own a huge footprint of homes in the city.

In the Bay Area, Redfin’s data groups cities like San Francisco ($657 billion), San Jose ($821 billion), and Oakland ($881 billion) as individual entities, which puts them outside the cutoff.

The average US home was valued at $495,183 as of December last year, up from $474,740 in the previous year. However, not every homeowner has seen their property increase in value.

The average home value jumped past $500,000 in both, the summer of 2023 and the summer of 2022, meaning the typical homeowner who bought during those times has lost value.

Lackluster Demand

Redfin Economics Research Lead Chen Zhao said that the US homeowners were sitting pretty and holding a massive amount of housing wealth, despite lackluster demand from buyers, because home values skyrocketed during the pandemic and now a supply shortage is preventing those values from falling.

“Prospective buyers aren’t as lucky. The combination of elevated mortgage rates, high home prices and a limited pool of homes for sale means homeownership is about as unaffordable as ever. One bright spot for buyers is that mortgage rates should start declining before the end of 2024,” Zhao added.