People wear protective masks as they walk down Via del Corso, Rome’s main shopping street, as the city makes masks mandatory outdoors in busy areas amid a rise in coronavirus cases, ahead of Christmas, in Rome, Italy, December 4, 2021. REUTERS/Remo Casilli

Chasing the Omicron dip

A look at the day ahead from Julien Ponthus.

Buying the dip triggered by the Omicron COVID-19 variant across global markets has proven a costly strategy so far. But some investors seem determined to have another go.

European and U.S. stocks futures are trading sharply higher after ending last week on a sour note and notwithstanding a dismal day in Asia where an MSCI index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) lost about 0.9%.

The region has seen a series of corporate setbacks after ride-hailing giant Didi (DIDI.N) decided to withdraw from the New York stock exchange last week.

Shares in China Evergrande (3333.HK), the world’s most indebted developer, plunged 14% after it said there was no guarantee it would have enough funds to meet debt repayments.

Another giant, Alibaba (9988.HK) dropped 5% after announcing it would reorganise its international and domestic e-commerce businesses. And U.S. regulatory opposition to the sale of Softbank-owned chip firm Arm pushed the Japanese conglomerate 8% lower (9984.T) read more .

But the mood is lighter already across Europe, allowing 10-year Treasury yields to claw back some of Friday’s falls which took them below 1.4% for the first time since late September.

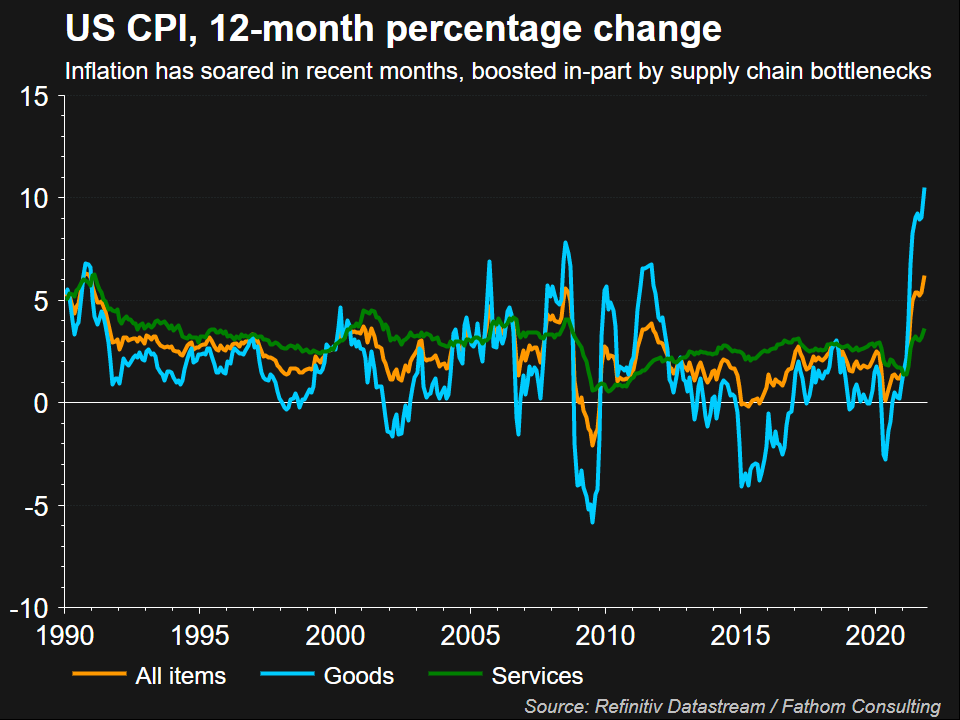

There are five trading sessions left before Friday’s U.S. consumer price report which some reckon will provide the green light for the Federal Reserve to accelerate its tapering of bond purchases.

Oil prices too rose by more than $1 a barrel after Saudi Arabia raised prices for its crude sold to Asia and the United States read more .

And if the market mood is perking up, there is no sign of that in Bitcoin which has fallen further and is now at $48,244 — some $20,000 below peaks hit a month ago.

Key developments that should provide more direction to markets on Monday:

-Vivendi is open to discuss with Rome over state control on TIM’s network read more

-Alibaba overhauls e-commerce businesses, names new CFO read more

-Swiss National Bank Vice Chairman Zurbruegg to retire in July 2022 read more

-Weaker foreign demand sinks German industrial orders in October read more

-CBI cuts UK economic growth forecasts on supply chain hit read more

-Euro zone finance ministers to discuss 2022 draft budgets, euro summit

– Russian President Vladimir Putin visits India

– UK construction PMI/new car sales

-Euro zone finance ministers to discuss 2022 draft budgets, euro summit

BOE deputy Governor Broadbent, ECB Governor Lagarde and board member Panetta speak:

Reporting by Julien Ponthus; editing by Sujata Rao

Our Standards: The Thomson Reuters Trust Principles.

This article was originally published by Reuters.