Customers at the Edeka grocery store buy pasta, as the spread of coronavirus disease (COVID-19) continues in Duesseldorf, Germany, April 29, 2020. REUTERS/Wolfgang Rattay/File Photo

Morning Bid: Peak inflation? We can only hope

A look at the day ahead in markets from Dhara Ranasinghe.

The European Central Bank’s plan to start tiptoeing away from monetary stimulus may be put to the test with Wednesday’s flash inflation release.

Economists polled by Reuters forecast inflation in the euro bloc rose 4.4% in January from a year earlier, easing from the previous month’s record high 5%.

That inflation peak is well anticipated, so a less pronounced decline could push up both the euro and bond yields across the single currency bloc. And the ECB, meeting on Thursday, will closely watch the data as well as market moves.

Note, Monday’s German inflation figures showed a bit of slowdown in January, though the print was above expectations and well above the ECB’s 2% target for the euro zone as a whole.

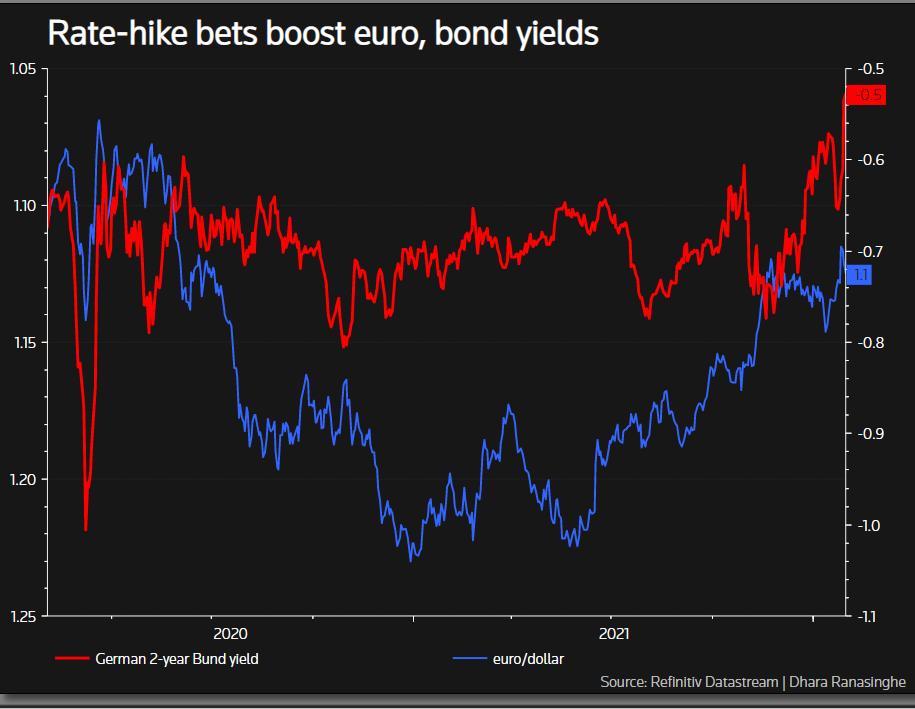

A ratcheting up of rate-hike expectations, with almost three 10 basis point rate rises priced in by year-end, has injected life into the normally moribund short-end segment of the German bond market.

Two-year bond yields, are around -0.47% this morning — the highest since April 2016. That’s up 14 bps already this week.

Meanwhile, the bulls are back in force in stock markets, supported by a flurry of strong earnings.

Google parent Alphabet Inc (GOOGL.O) reported record quarterly sales late Tuesday. Spain’s Santander (SAN.MC) just reported an eightfold rise in Q4 net profit versus the same 2020 quarter.

No surprise then, that European stock futures are up 0.5-0.6%. Futures are also pointing to a positive start for Wall Street later in the day and the VIX volatility index which rose almost to 40% on Jan. 24, closed Tuesday below 22% (.VIX).

Elsewhere, oil prices headed back towards last week’s seven-year highs as a draw in U.S. crude stocks confirmed strong demand and a lack of supply, but investors remained cautious ahead of an OPEC+ meeting later in the day.

Key developments that should provide more direction to markets on Wednesday:

– Sony smashes estimates with 32% rise in Q3 operating profit

– Santander Q4 net profit rises 8-fold, releases 750 mln euros provisions

– U.S. January ADP employment change

– Central Bank of Brazil monetary policy decision Earnings: Meta, AbbVie, Novo Nordisk, Thermo Fisher Scientific, Novartis, Qualcomm, T-Mobile US, Santander, Sony, Spotify Reporting by Dhara Ranasinghe; editing by Sujata Rao

This article was originally published by Reuters.