Gold sales soar in UAE During 2021

According to the World Gold Council (WGC), the volume of gold sales in the UAE grew by 55.4% to 41.5 tons in the past year compared with 26.7 tons in 2020.

In its Gold Demand Trends report, the Council said jewellery accounted for 80.8% of the total volume of gold sales in the UAE in 2021, registering 33.8 tons, compared with 21.5 tons during 2020. The trend continued in the first month of 2022 as gold sales increased due to declining prices of the precious metal.

Safe Option

It is generally believed that investing in gold or in real estate is a safe option in view of the rising inflation. The US Fed’s hawkish stance and its decision to increase interest rates from March, spurt in crude oil prices and weakening dollar and rising tensions between the US and Russia over Ukraine are other reasons cited for the investors’ mood to stay away from backing risky assets.

The Dubai Gold & Commodities Exchange (DGCX), the largest and most diversified derivatives exchange in the Middle East, registered a monthly Average Open Interest (AOI) of 128,828 contracts in January – and the total value of trade was close to $8 billion during the month.

DGCX CEO Les Male said: “Volatility in the equity markets, expectations of interest rate hikes and high oil prices – amongst several other factors – had an impact on trading in January, as market participants looked for safety in response to global economic headwinds.”

The official further said: “Looking ahead, we see these trends continuing in the short-term and expect increased demand for our derivative products as market participants look to hedge and off-set their risk. We can also share that we have a robust pipeline for 2022 and will soon introduce a number of contracts and services that will appeal to our member base.”

Annual Sales

The DGCX recorded a yearly AOI a sum of 1,985,584 contracts and traded 7,076,350 contracts during the year – with the total value of the contracts amounting to $150 billion.

The average daily volume was 27,322 lots and the highest daily volume was 121,570 lots on 26 February 2021.

As part of its broader cross-border collaboration efforts, the DGCX has signed landmark agreements with the S & Royal Group Mongolia to explore future business and trade opportunities, as well as the Financial Markets Regulatory in Sudan, to strengthen the gold market across Africa.

Additionally, the DGCX also signed a strategic MoU with Victoria Falls Stock Exchange (VFEX) aimed at supporting with the development of a clearing and settlement commodities exchange in Zimbabwe.

Outlook For 2022

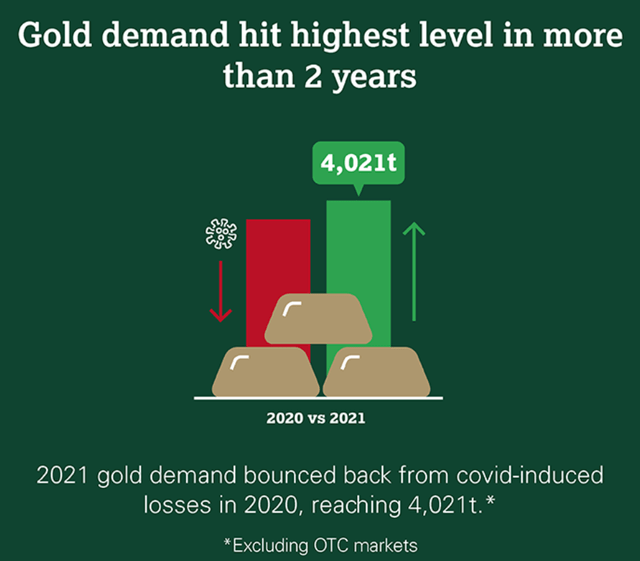

In its outlook for this year, the WGC said despite potential rate hikes, real rates will remain low. Gold may face similar dynamics in 2022 to those of last year, as competing forces support and curtail its performance.

Near term, the gold price will likely react to real rates in response to the speed at which global central banks tighten monetary policy and their effectiveness in controlling inflation.

“Yet, in our view, while rate hikes can create headwinds for gold, history shows their effect may be limited. At the same time, elevated inflation and market pullbacks will likely sustain demand for gold as a hedge. Jewellery and central bank gold demand may provide additional longer-term support,: the Council added.

Best performing product – Indian Rupee Options (DINRO), up 1,233% Y-o-Y