Robo-Advisors Play Crucial Role in Middle East’s Wealth Management Industry

By V L Srinivasan

The Middle East accounts for most of these individuals and their numbers are likely to be doubled due to the exponential growth of their wealth by end of this year. These individuals are highly sophisticated and look for quick access to information along with innovative smartphone solutions.

They also demand highly personalized services and prefer niche portfolios to their interest with sustainable ways to invest. This is the next generation of customers that are most likely to embrace WealthTech solutions.

Middle East Is Their Home

The Middle East is the home for nearly 390,000 HNWIs till December 2020 compared with 414,634 millionaires in 2019, according to report published by South Africa based research firm New World Wealth.

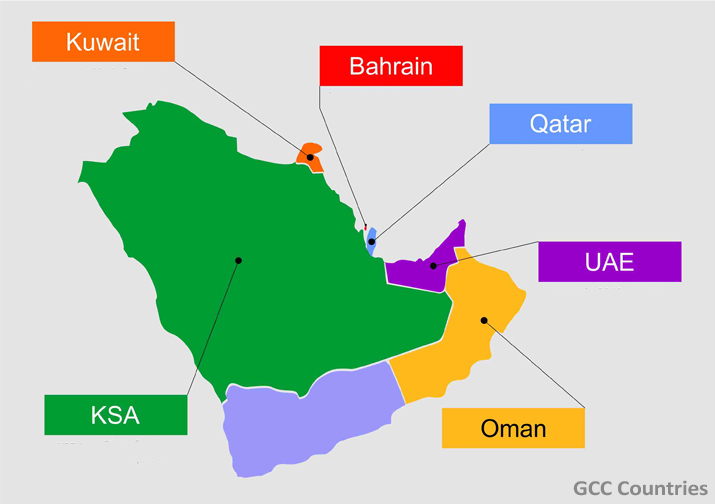

The report also said that among them, 146,600 HNWIs are located in the three GCC countries – UAE (83,400), Saudi Arabia (40,700) and Qatar (22,500) – and they hold $1.614 trillion in assets. However, compared with 2019, there has been a drop in 18% in HNWIs numbers due to the pandemic in 2020.

The total private wealth of HNWIs in the UAE grew from $825 billion in June 2020 to US$870 billion by the end of December 2020. Likewise, the total wealth of HNWIs in Saudi Arabia and Qatar rose from $530 billion to $542 billion and from $195 billion to $202 billion respectively, the report added.

Another report from Knight Frank Middle East said the number of UHNWIs in Saudi Arabia grewby 9.6% in 2020 and registered a growth of 227% over the last five years, the fastest growth rate globally over this period, Approximately $440 billion of Middle Eastern HNWI wealth is tied up with wealth management companies and 25% of this wealth is managed by the largest wealth management centre in the UAE, the report said.

BCG Estimates

The Boston Consulting Group estimates that the Middle East region’s HNWI/UHNWI population will grow at 14.1% through to 2022 – double the global rate of 7.4%. By then, the Middle East’s wealth per capita is expected to increase to $25,000, from $18,000 in 2017, with total personal wealth forecast to grow 8%-10% annually from $3.8 trillion in 2017.

Deloitte estimates that the global robo advisory market is expected to reach between $2.2 trillion to $3.7 trillion in assets under management by next year and to $16 trillion by 2025. Separately, EY estimates that digital approaches to wealth management, a sector it calls holistic management, will comprise 30% of all worldwide assets under management.

With the number of HNWIs and Ultra HNWIs swelling in the region each year, especially in the UAE and Saudi Arabia, the robo advisory industry is expected to play a critical role in managing their assets.

Robo-advisors are a class of financial advisors who provide financial advice or investment management online with moderate to minimal human intervention.

They provide digital financial advice based on mathematical rules or algorithms, and use technology to interact with more tech-savvy clients, as opposed to the traditional method of relationship-based advisory. This technology allows investment managers to provide tailored investment management services to clients in a cost-effective and scalable manner.

Demand from the investors along with changing landscape of financial service sector in the region is one of the reasons cited for the growth of the region’s robo advisory market, which is expected to grow at an overall compound annual growth rate (CAGR) of 55.94% and likely to be around $4 billion in the next couple of years.

The two economic power houses in the Middle East – the UAE and Saudi Arabia – are aiding the growth of robo advisory industry and the UAE has been most encouraging in terms of revenues for robo advisory market.

FinTech Ecosystem

What is driving the growth of region’s home grown robo-advisory industry is the thriving fin-tech sector. Local firms like Sarwa, Singapore’s StashAway and the US-based Wahed Invest Inc in the UAE have established a strong base.

In July 2019, the Financial Services Regulatory Authority (FSRA) of the Abu Dhabi General Market (ADGM) issued a regulatory framework for robo-advisors.

Among the banks, Commercial Bank of Dubai became the first financial institution to launch an innovative app – CBD Investr app – to offer a robo-advisory investment solution.

Developed in partnership with Belgium’s InvestSuite, a wealthtech company, this app is powered by smart algorithms that actively manage investment portfolios to deliver optimal risk-adjusted performance.

StashAway has expanded to the UAE to tap the growing mass affluent segment in the MENA region. StashAway is the first robo-advisor to receive an asset management licence from Dubai authorities with retail endorsement.

Bahrain has been well placed to meet the industry’s growing demand and has already introduced a set of regulations to monitor the robo-advisory companies. In Kuwait, NBK Capital and Neo Technologies have developed its digital investment service NBK Capital SmartWealth.